When you buy shares in a publicly listed company you have to go through a broker. The broker is an intermediary between you the ‘buyer/seller’ and other brokers that also have ‘buyers/sellers’. The way a broker makes money is through repeated transaction fees and not by owning shares themselves. The broker buys at one price and sells to you ( if you are a buyer) at a higher price therefore making a small commission and vice versa if you are selling. Now if you are a trader and therefore doing hundreds of transactions per month the difference between the two prices will impact on your trading account if the bid-ask spread is too wide but it doesn’t have any real meaning to long term investors; Or does it? Let’s look at Arbuthnot Banking.

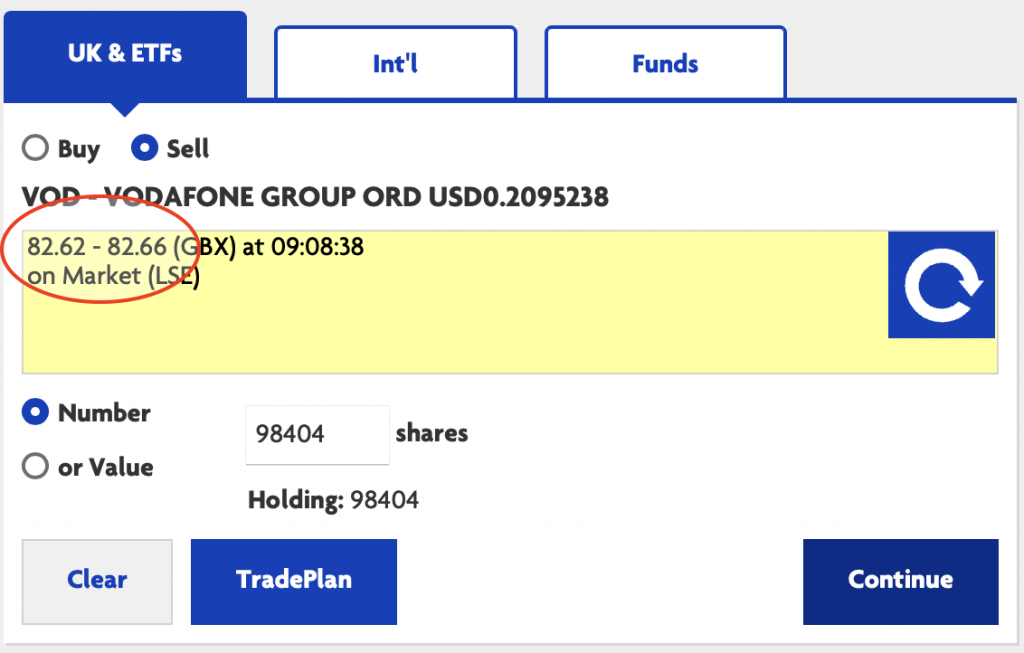

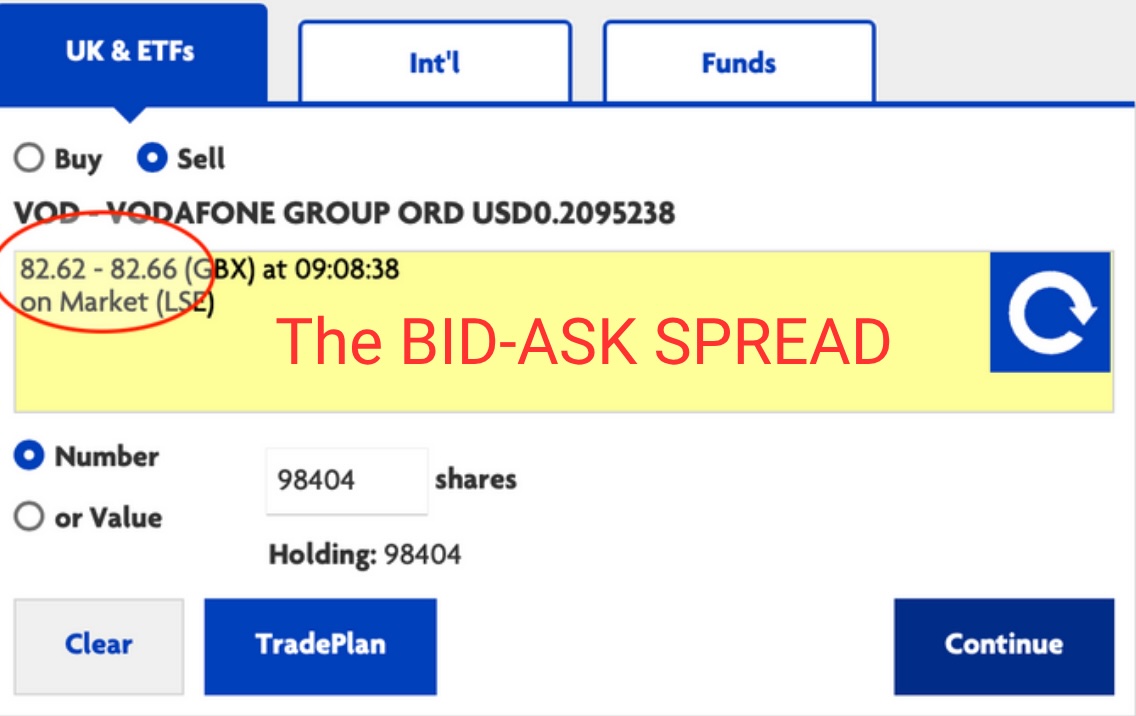

Bid-ask spread of Vodafone

Before we discuss the bid-ask spread of Arbuthnot Banking let’s look at an alternative company. VODAFONE

As you can see the bid-ask spread for Vodafone is 0.04 of a penny per share. Given that there are 26 Billion shares in circulation and hundreds of millions of shares are traded daily the bid-ask spread doesn’t have to be huge to make a considerable amount of money for a broker. Vodafone is an extremely large company.

Bid-ask spread of Arbuthnot Bank

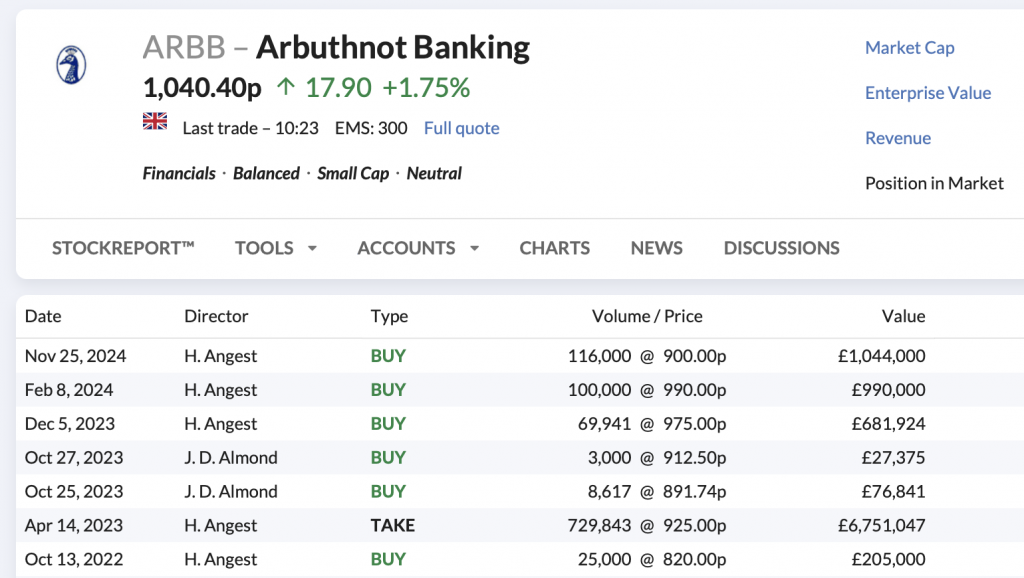

In addition to the fact that Sir Henry ( it’s chairman ) was acquiring huge sums of shares using his own money, I was attracted to Arbuthnot Banking because it had just gone through a restructure, revenue and profits were on the increase, plenty of cash in the bank, no debt and a tidy dividend of over 6%. What’s not to like. Sir Henry Angest’s own investment just tipped the balance for me and I bought in. HOWEVER…

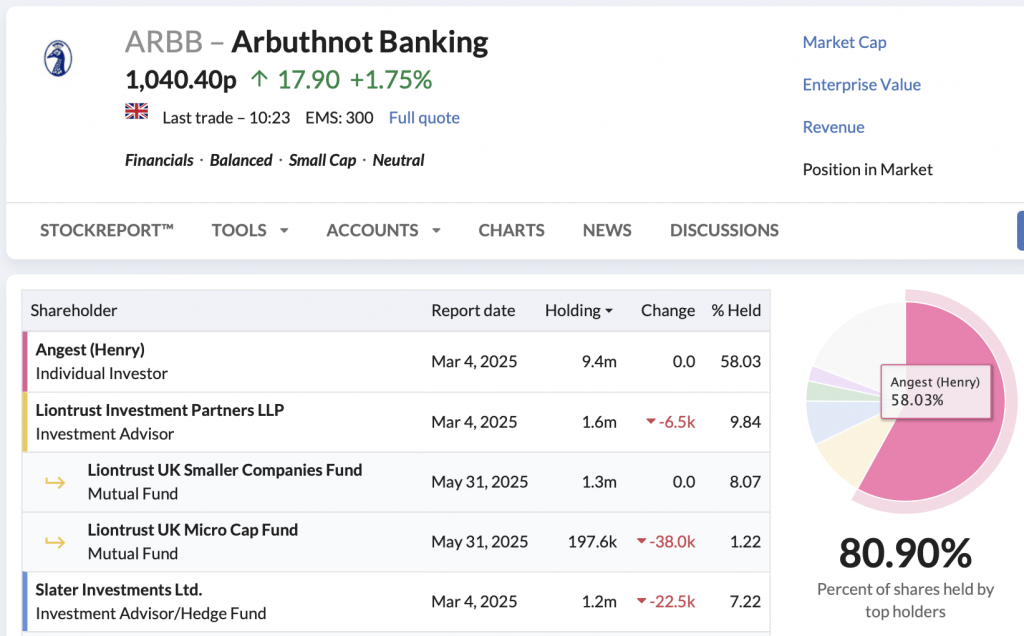

What I failed to spot was the fact that Arbuthnot Banking have only issued 16 million shares so there aren’t many in circulation to buy and sell. Furthermore I also failed to spot that Sir Henry has acquired a whopping 58% and he’s not selling. All this means that there are only 6.7 million shares floating about to be bought and sold. It could also be the case that all the other major shareholders aren’t selling their shares either which adds an extra dimension to the bid-ask spread. Let’s take a look at what this means .

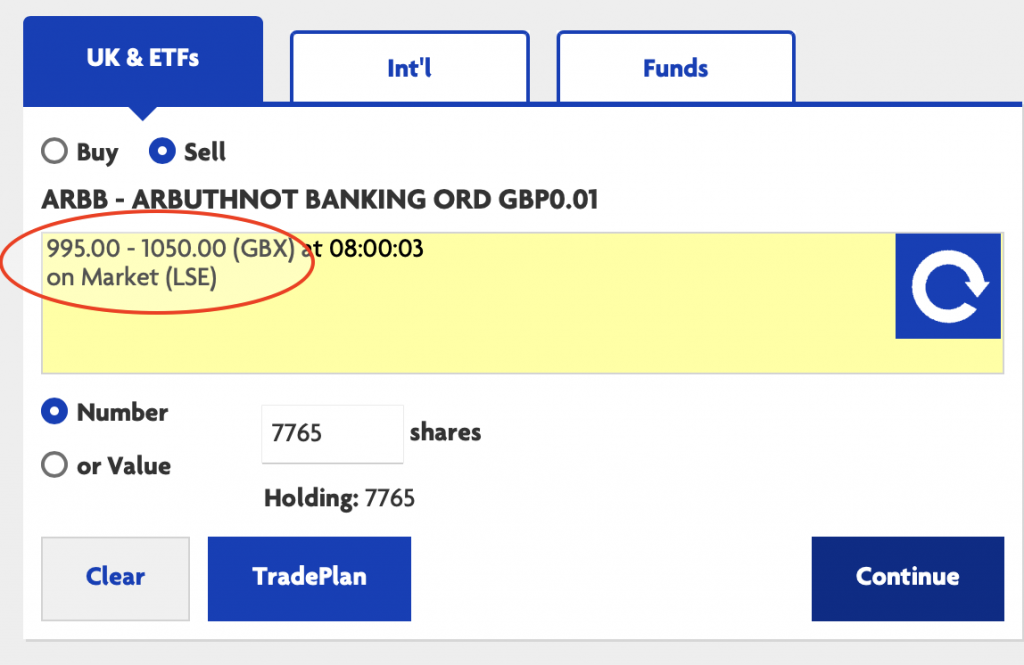

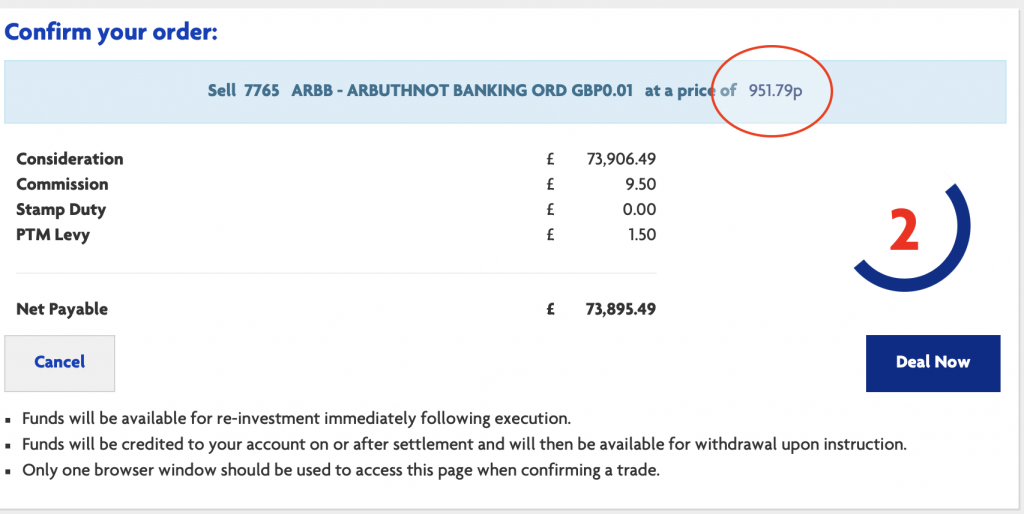

As you can see from the image to the right the bid-ask spread is not 0.04 of a penny like Vodafone but a whopping 55p per share. There are simply no shares moving about for the broker to make lots of tiny commissions on so they have made the spread extremely wide enough for them to make a bit with what little activity there is.

So what does this mean for me. I bought at £10.30 a share and because I have found something better to invest in I would like to sell my shares at the same price I bought them at having had a dividend of over £2200 pounds and move on. £10.30 is sort of in the middle of the spread so let’s see what they are offering me.

Arbuthnot Banking- Sales price offer

Not only can the broker not manage to give me a price to sell ( let alone somewhere in the middle) within its’ range that it initially offered, it is another 40p per share lower than the lowest price in the range once I ask for a definitive price.

Clearly this is not acceptable to me as I would be losing money on the deal all thanks to the spread.

Conclusion

I haven’t really taken too much notice of the spread over the last 15 years and It hasn’t bitten me on the bum… until now. Maybe that was sheer luck, I don’t know, but one things for sure. I’ll be paying a little more attention to the spread from now on. The smaller the company, the less shares in circulation, the greater the spread for the broker to work with to make a bob or two. It’s not as if the information was hidden from me. It’s all there on Stockopedia so ‘MY BAD’.

So what are my options? The company is still a good company. All the figures are going in the right direction and then there’s that tidy dividend. All I can do is keep collecting the cash and wait for the spread to be more favourable to me.

0 Comments