It always baffled me that if I wanted to buy shares in a particular company they were readily available. How is that possible? What if there weren’t any for sale at the time I wanted to buy. Let’s face it if you want to buy apples from the apple seller and he’s run out you can’t buy any so how is it possible to be able to buy shares at any given time? In this blog ‘How to buy shares? Stock market investing for beginners’, I’m going to explain how the stock market works and why it’s always possible to buy and sell shares whenever you want.

The Stock Market and the people who work in it

The stock Market works exactly the same as any other market with one exception. In a normal market the seller takes the goods to the market to sell. When those goods have sold out you can’t buy anymore. In the Stock Market there are specialised firms (or departments within firms) that are obliged, under license by the exchange, to ensure that shares are made available at all times for anyone who wants to buy and are obliged, again under licence, to accept shares at any time if you want to sell. This is called LIQUIDITY and the people that do this are called MARKET MAKERS. Liquidity is the key difference between the Stock market and all other markets. The market makers must continually quote prices to buy and to sell. The difference between the buy ( BID ) price and the sell ( ASK) price is called the BID ASK SPREAD and this is their profit. Let’s go through an example.

How to buy shares in the stock market – Rolls Royce Example

So you have 1000 Rolls Royce shares you want to sell. The market maker says I’m willing to take your 1000 shares and this is the price I want to pay for them (BID). On the opposite side of the coin you want to buy 1000 shares of Rolls Royce. The market maker then says OK I will sell you 1000 Rolls Royce shares and I’m asking this price for them (ASK).

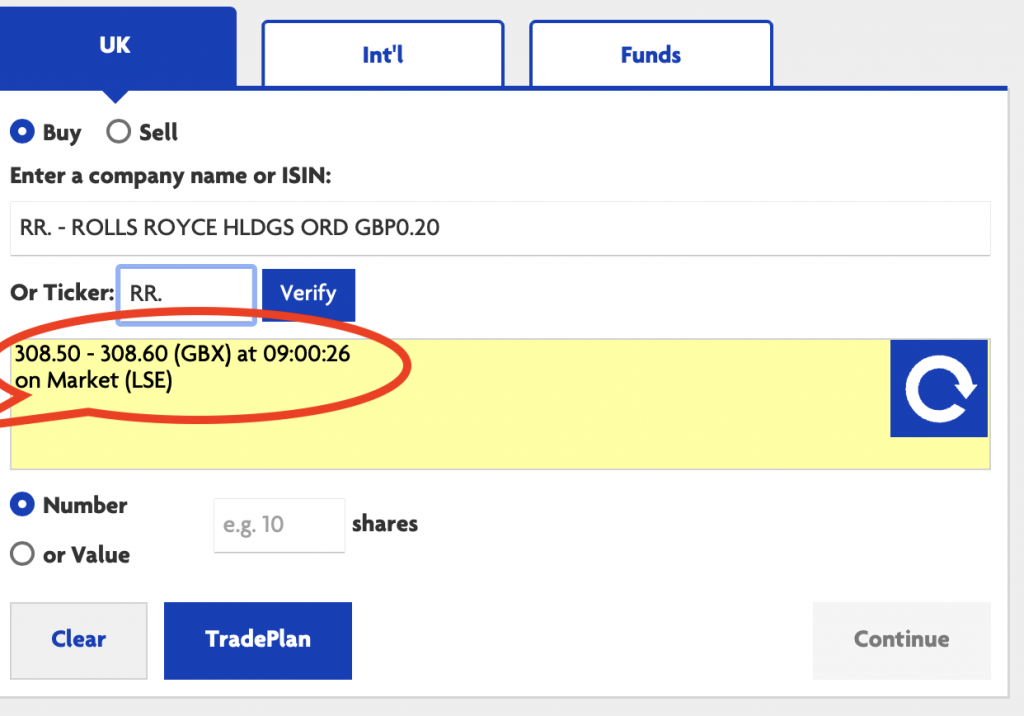

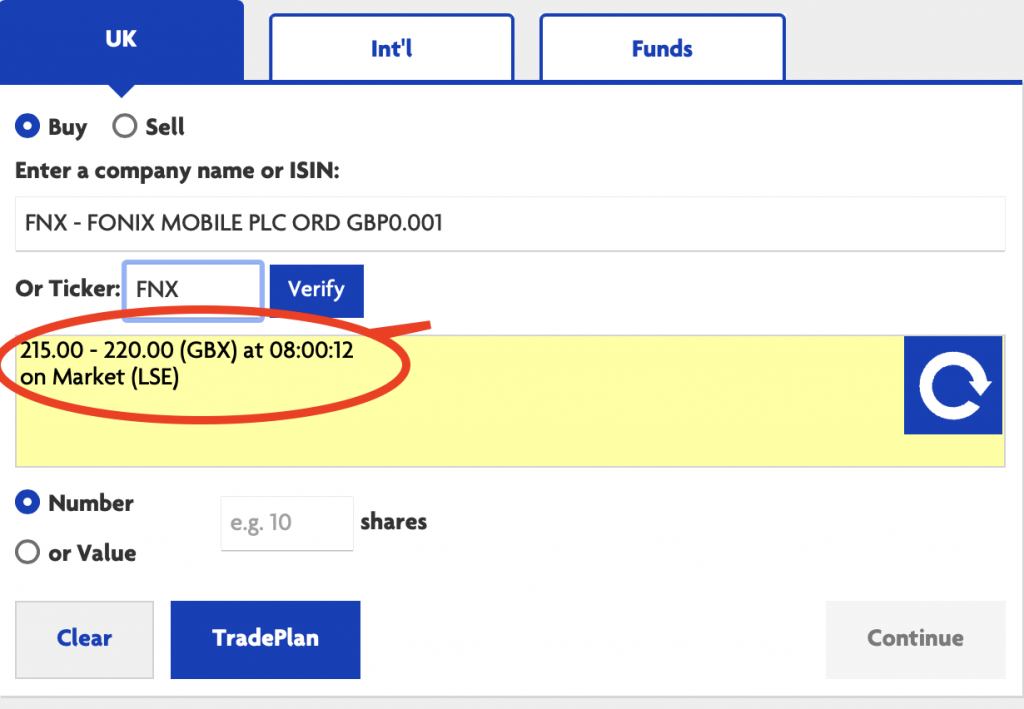

Now, the market maker is taking a risk having these shares on his books because as we know share prices fluctuate constantly. Certain companies share prices fluctuate less than others due to things like stability, size and age of the company and this is reflected in the BID ASK SPREAD. We can see from these pictures that the bid and ask prices for Rolls Royce is 0.10 of a penny spread. Fonix mobile, however, is not so well known and therefore the BID ASK SPREAD is much wider at 5 pence. As investors it doesn’t make any difference to us because we either accept the prices offered, whether we are buying or selling, or we don’t.

Rolls Royce

Fonix mobile

The Broker’s role in the stock market

The broker is the intermediary between us, the investor and the market maker. We cannot directly interact with the market maker so we have to use a broker. There are two types of account we can open up with a broker; Execution only or Full Service. I use an execution only account because all I want the broker to do is buy and sell shares from the Market Maker. A full service account gives you all the resources the brokerage house has to offer; Analyst reports, advice, portfolio management, access to cash loans and share borrowing services etc.

How to buy shares? – Your online broker does it all

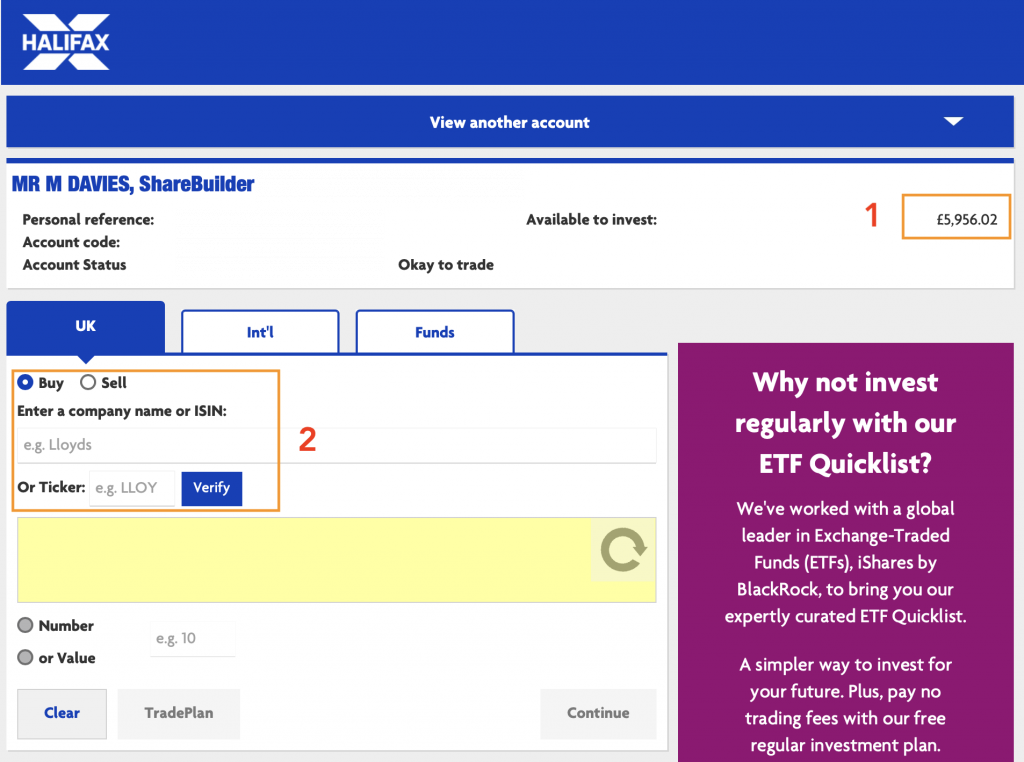

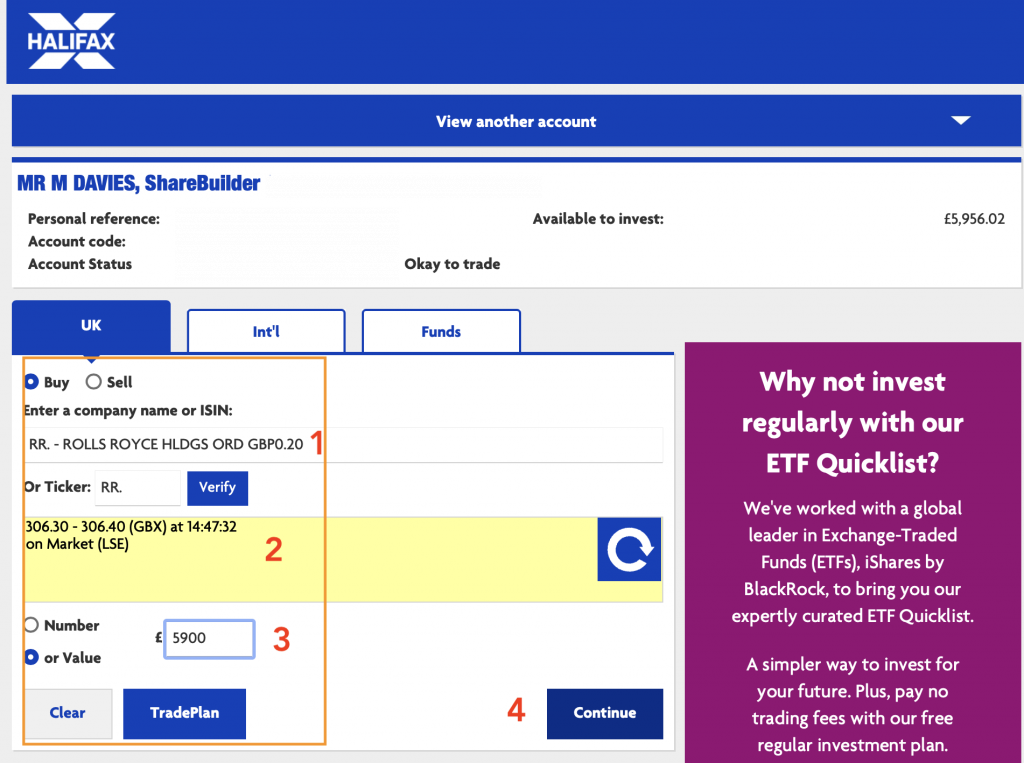

Let’s take a look at how my online broker account helps me to buy shares. Here are a few screenshots of my online account.

How to buy shares

I’ve logged onto my account and as you can see in box no 1 ( top right) I have £5900 (ish) to invest. I transferred the money from my personal bank account. When you setup your online broker account you allocate a bank account to transfer money in and out of to fund or receive cash from your broker account. In box 2 I have the option to either buy or sell and underneath that I type in the company I’m interested in.

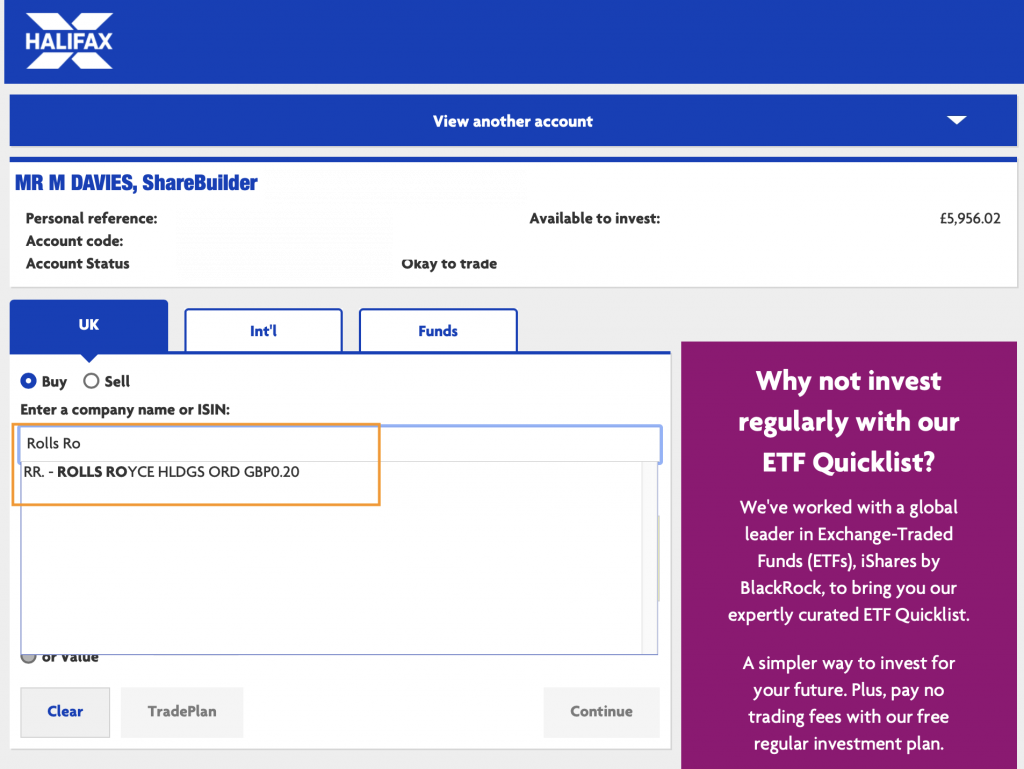

I want to buy Rolls Royce

As I start to type in Rolls Royce the software identifies the company and its Ticker ( every company has a code to identify itself on the Stock Market). Not surprisingly, Rolls Royce ticker symbol is RR. I can now click on the company that the software has found and it will go and get the current prices ( as given to them by the Market Maker).

The bid-ask spread

Point no 1 highlights the company (Ticker symbol RR).

Point 2 is my bid-ask spread.

Point 3- I type in how much I want to invest or the number of shares I want to buy

And when I’ve filled all that info in I click Continue ( Point 4) which asks the broker to get a definitive price for me.

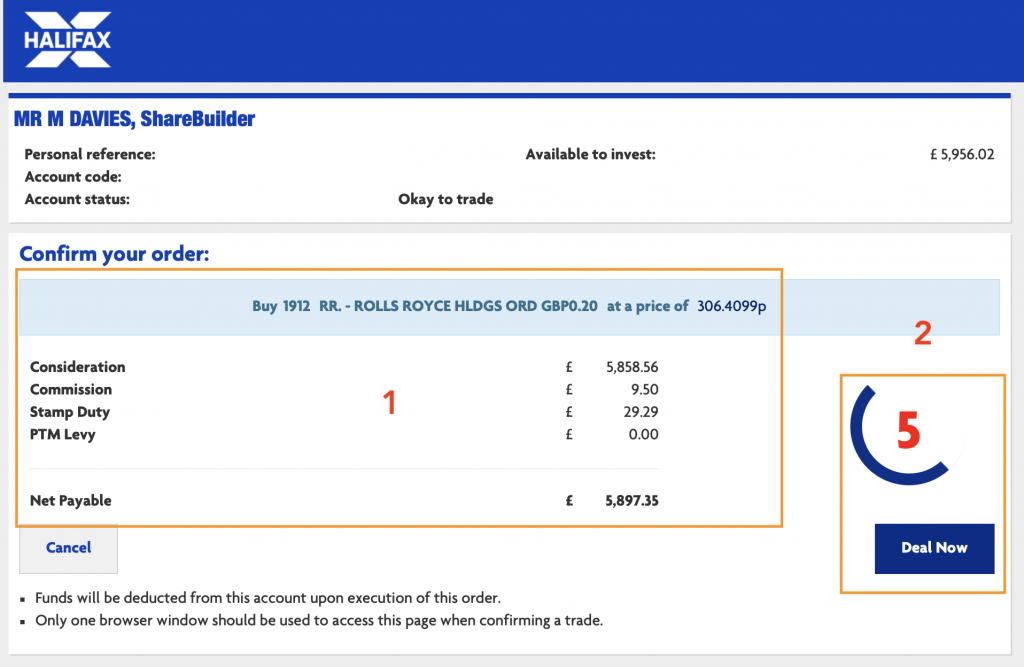

My share price quotation

As you can see in Box no 1 I now have a definitive quotation which includes how many shares I can buy with my £5900, the price for each share and the costs which have already been taken out of my £5900. In box no 2 I now have 15 seconds to press deal. If I don’t want to deal I just let he clock run down or I press cancel.

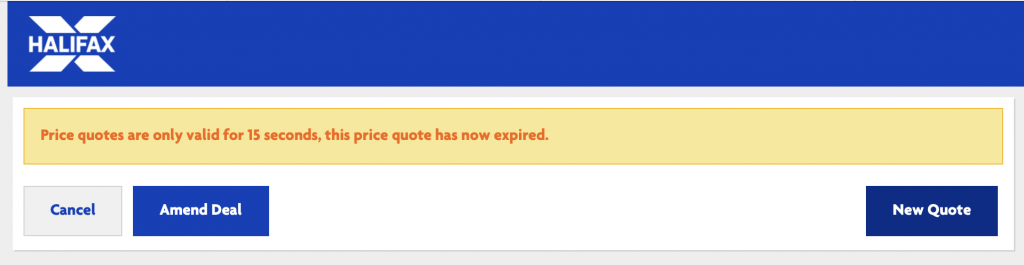

Letting the clock run down

When you let the clock run down you have the option to cancel, amend the deal or request a new quote and the process starts again.

This is how to buy shares in the Stock Market.

In a nutshell, that’s it. Nothing complicated about it. Behind the scenes there are people that offer shares to buy or sell at any given point in time (when the market is open of course). All you have to do is open an account, put some money in it and start investing. You do not have to engage with a human being, there’s no sales pitch and you don’t have to collect paper shares and store them. It’s all done for you. Each time you place an investment you leave a paper trail (now a digital trail).

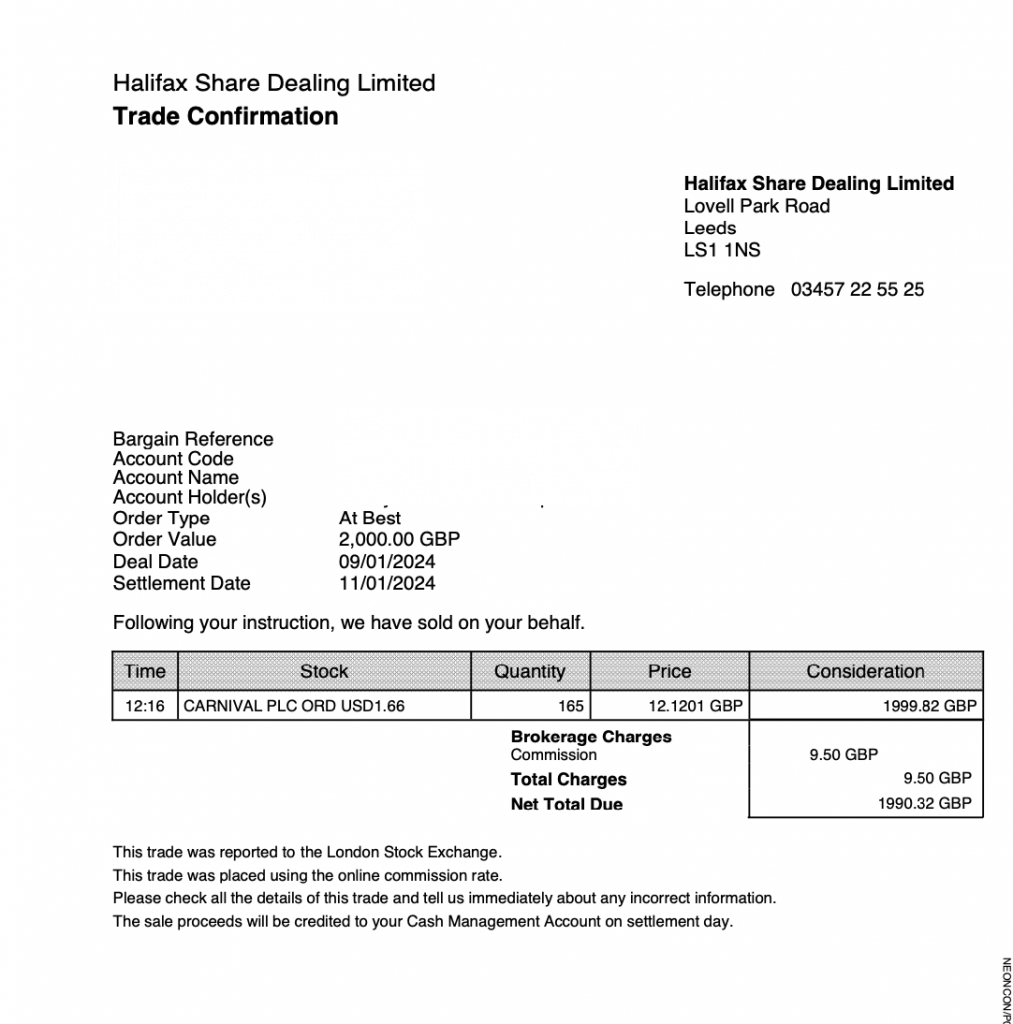

Your Paperwork

Let’s assume you decided to buy Rolls Royce shares. What happens now? Well, for each transaction you get a contract note detailing everything you need for your income tax return. This is stored digitally at the brokers end until you need it and it looks like this.

And finally, your Portfolio Valuation

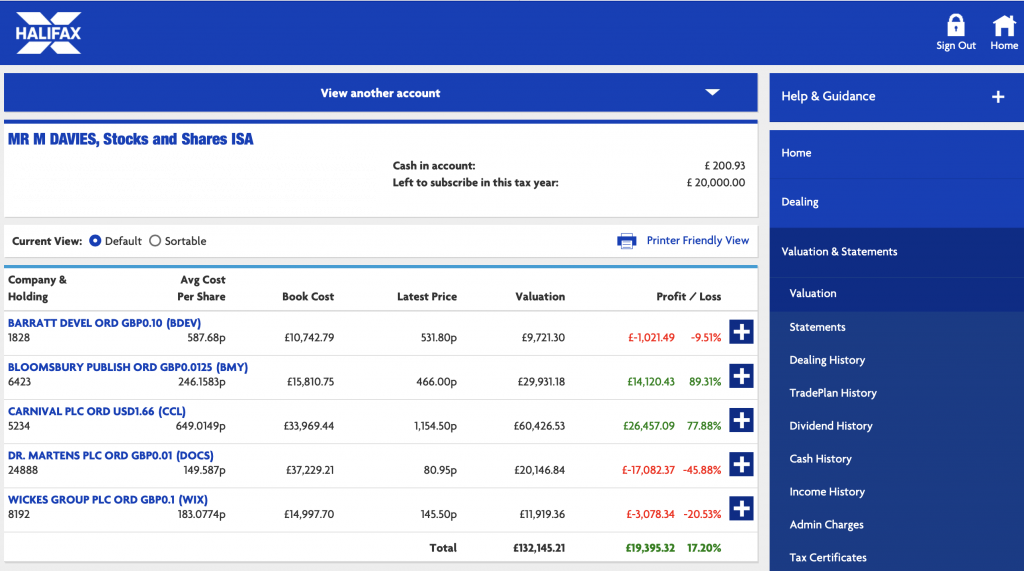

This is your main screen detailing your whole portfolio, current valuations on the left and your account management menu on the right. Just click on any menu option and you have full administration control of your investments. If you click on the company names on the left (in blue) this will take you to your dealing history for each company.

Conclusion – How to buy Shares and the bad news

To get access to the dealing side of the stock market and to have this portfolio administration platform at your fingertips on all devices wherever you are in the world you are, I’m afraid, going to have to pay an administration fee ( as well as your dealing charges). Well, you didn’t think it would be free, did you? Brace yourself because for all this the annual administration charge is £36.00, I know, that is a deal breaker right? I hope it isn’t because if you’re patient and can learn the techniques for making good quality investments, the stock market can provide a life changing path to financial freedom. In the next blog I’m going to explain some very simple strategies that produce good returns in the stock market whether you are interested in capital growth or need to boost your income. Don’t go away.

Thanks for making this a little more daunting!

Oops sorry for the above 😲

Little LESS daunting!

I’m glad you added ‘Less’. Lol

Thank you Myles… I will have a re read at the next stopover… already you have helped my understanding…. Looking forward to the next lesson 👍😊

Thanks Myles – this is something that has intrigued me for a while and would definitely like a dabble!

How long have you been doing this and do you log in every day to trade or do you leave it for periods of time?

Looking forward to learning more from you 👏🏻

Hi Sally, hopefully I can get you up to speed and raring to go. I’ve been stock market investing for 15 years. In one of the blogs coming up I will discuss the difference between trading ( day and swing) and investing. I’m a long term investor so whilst I might log on to see what’s happening, I buy and sell infrequently. Glad to have you onboard.

I’m very grateful for ( and actually inspired by) that. Thank you.

Makes my heart sing when people say things like that. Thank you