So, if you’ve read my previous blog you now know how easy it is to buy shares through an online broker account. If you haven’t read it yet click here. Now what do you do? You want to start buying shares in companies but you have no idea where to start. With over 63000 companies listed on stock exchanges worldwide it’s a bit of a minefield. In this blog, Mastering the art of stock market investing: 3 proven strategies, we’ll explore 3 ways to start your investing journey but first let me ask one question.

What is investing?

Investing is the process of buying assets that you hope will grow in the future thereby giving you a return on your investment further down the line. However, every investment comes with risk as does anything worthwhile in life and the higher the risk the better the return. This is the risk/reward ratio. Adding layers of protection for your capital is the difference between investing and gambling and the 1st layer of protection is having a strategy and sticking to it.

3 proven strategies for stock market success

A strategy is a methodology of choosing companies to invest in based on your required outcome. Some people like to see capital growth, some like extra income. Some like a mixture of both. Before we get stuck in you need to understand what you’re investing in. when you invest in the Stock Market. COMPANIES.

Lifecycle of a company

I mentioned in a recent post on my Facebook page that if you invest in a house or gold you are buying 1 house or 1 block of gold. The prices of those commodities may fluctuate due to market conditions but in 10 years time you will still only have 1 house or 1 block of gold. A company is a living organism. It starts off as an idea in someones head, it’s life starts small, it grows and grows and if it is managed properly it becomes a leader in it’s field, a powerhouse of it’s industry. The whole purpose of a company is to make profits and reinvest those profits back into the business to grow and expand. When you buy shares in a company you are buying little pieces of a living organism and you can classify companies depending on where the company is in its lifecycle. In his book, One up on Wall Street, Peter Lynch classifies companies into these categories; SLOW GROWERS, STALWARTS, FAST GROWERS, TURNAROUNDS AND CYCLICALS. Classifying companies this way helps you understand what you can expect from them. For instance if you want to grow your capital it’s no good investing in a SLOW GROWER. In this blog I’m going to concentrate on SLOW GROWERS/STALWARTS, FAST GROWERS and TURNAROUNDS and the strategies needed to make good investment decisions and the 1st strategy is the DIVIDEND STRATEGY

The Dividend Strategy

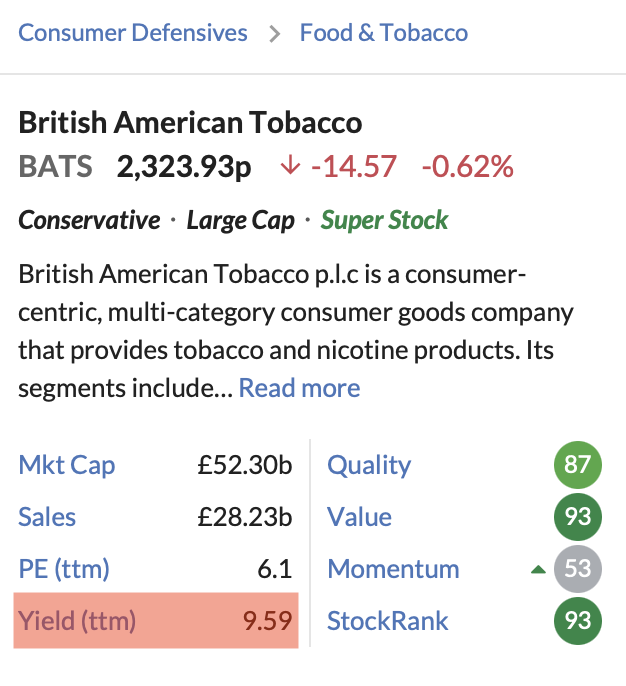

As companies grow they reinvest all their profits back into the business ( to buy more equipment, expand into new markets, develop new products etc) but there comes a time when the company has reached a point of saturation in it’s industry and can’t invest the profits efficiently back into the company so it gives a portion of these profits to shareholders as a ‘THANK YOU’ for owning shares in the company. This is called a dividend and usually but not always you’ll find dividend paying companies in the SLOW GROWERS/STALWARTS category. Look at the three companies below.

The dividend yield is the cash return you will receive if you own shares in these companies. Right now British American Tobacco are offering a 9.59% dividend. Consider the dividend yield of a company as the interest you receive in a bank account and it should be instantly obvious that by investing £10,000 in British American Tobacco shares you will get a far better return than any current bank interest rate can offer. There is one big difference. Whereas a bank interest is fixed ( for the stated period), a dividend payout by a company is discretionary each year at the annual board meeting so if the company hasn’t done so well the management might decide to reduce the yield or indeed stop paying a dividend at all as was the case during covid. Investing in dividend paying companies is a widely used strategy by many investors worldwide and one I use often.

How you manage you dividends

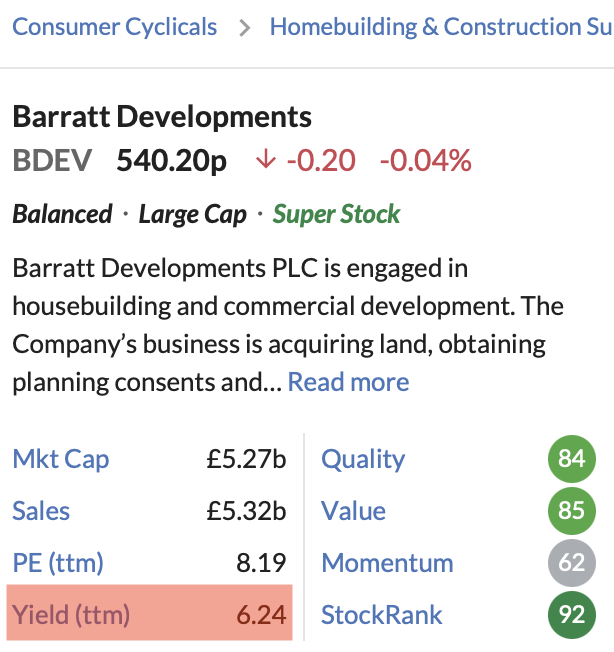

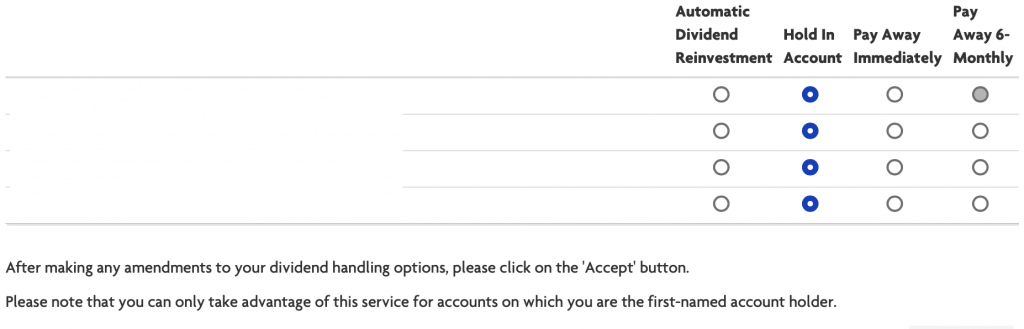

When the company issues an announcement about what dividend will be distributed your online broker will receive the cash amount and add it to your cash balance in your account. There are 4 different options you can do with the dividend once it has been received by the broker as you can see by the image below

You can automatically reinvest the cash and buy more shares in the same company on the day you receive your dividend. Your broker will do this without asking you. You can pay the money straight into your bank account once the broker account receives it, you can collect all the dividends and pay it into your bank account after 6 months or my preferred option is to keep it in my account as cash because I want to build my portfolio. Leaving it in cash means I can wait until I get a good price and then reinvest.

The fast growers or momentum Strategy.

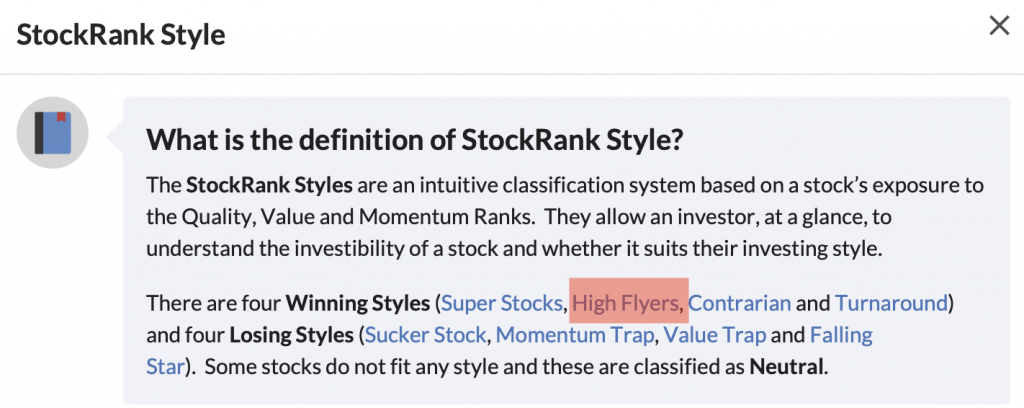

Before a company pays a dividend, they take all the profits and plough them back into the business in order to expand, capture new markets etc. This is the growth phase of a company. There is a direct correlation with share price and the growth of a company. If a company grows its’ sales and profits by 20% each year for 10 years the share price will follow suit. This strategy is purely for capital growth and is a medium to long term investment. Whether my research website Stockopedia followed Peter Lynch with his company groupings or not I don’t know but they have created their own groupings and we can see these here.

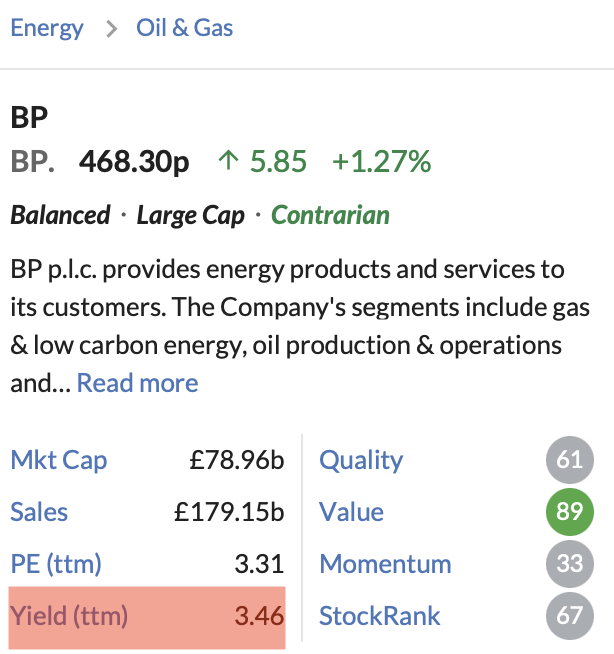

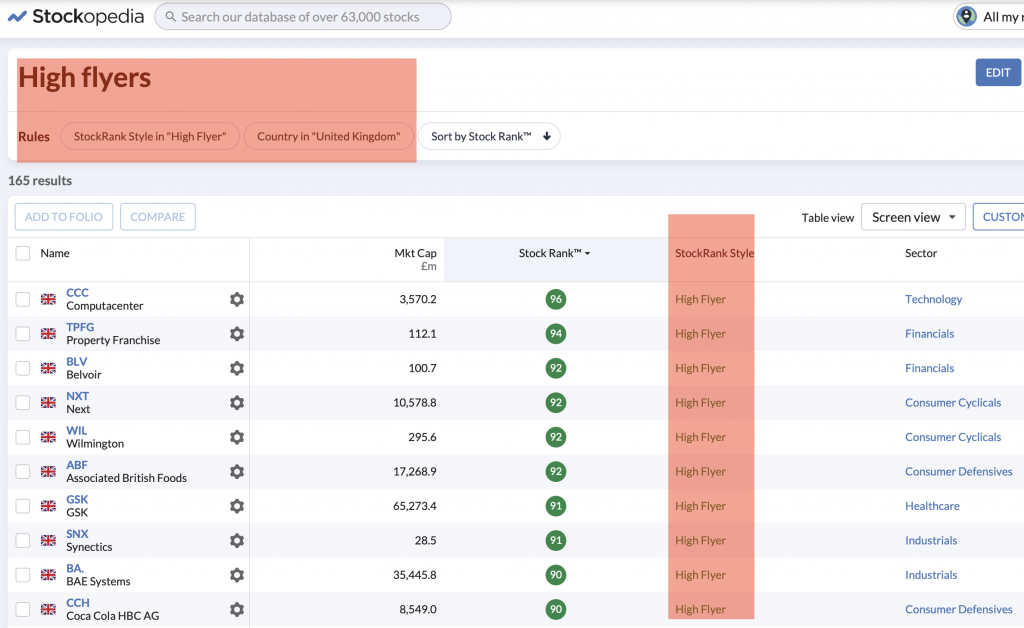

Stockopedia calls their growth companies High Flyers. Companies are grouped together based on a rigorous set of criteria so it’s easy to identify these types of companies and they way you do that is by creating a screen. A screen is a filter where you add rules based on what you want to look at and the screen filters out all the companies that you are not interested in. Here’s an example.

In the 1st red box I have added two rules ( this is just a basic screen for demonstration purposes). I’m looking for companies that fit into the growth or high flyer category and I want them to be in the UK. Out of 63000 results I’ve now narrowed it down to 165. I can now go into some of them and investigate further. A stock picking screen is essential for breaking the stock market down into smaller chunks for you to digest.

The Turnaround Strategy

I love this one. Humans being what they are make mistakes and company directors are not exempt from this problem. So from time to time companies that used to be good solidly run enterprises full of promise have a blip/make mistakes/make wrong decisions etc and the share price plummets. You see, in a world of volatility, certainty is king and when a company cocks up, everybody sells and the share price sinks with it. However, just because the company has made a huge gaff doesn’t make it a bad company overnight.

A classic example was Coca Cola in the 1970’s. Pepsi was vying the the no1 soft drink spot and came out with the classic ‘The Pepsi challenge’ advert where they asked the general public to differentiate Coca Cola from Pepsi cola using plain cups. The advert was so successful that the Coca Cola board of directors created a new recipe and called it New Coke. When it was launched all the major shareholders panicked and sold off all their stock and the share price tanked. The board realised their error and if you had bought shares after the big sell-off you would have made a fortune.

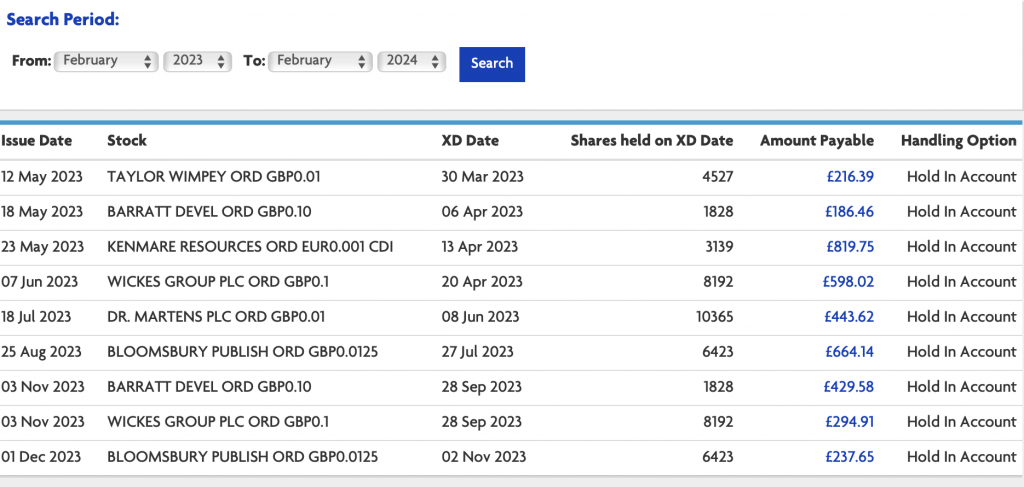

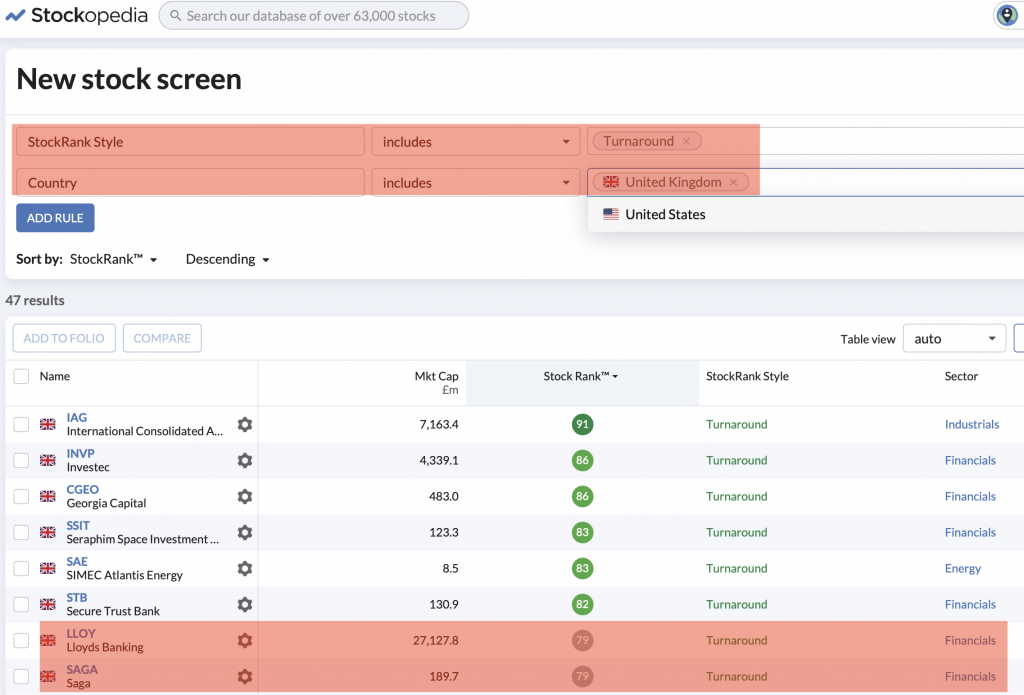

So, how do we find these companies. Stockopedia to the rescue once again. Here’s a screen I created to filter out all the companies that fit into TURNAROUND category

I have highlighted two that immediately take my fancy. Lloyds banking and Saga. We all know what happened during the credit crunch and lloyds was bought out by the government to save its neck. Now it seems, it is showing signs of recovery so this one is worthy of further investigation. Saga, well if you are of a certain age, like me, you know that Saga caters for the over 50’s consumer group and as I fit into that category I would like to investigate more to see if it is something I’d be interesting in.

Turnaround companies are a great way to build capital because when people make huge mistakes they tend to be more cautious after the fact ( once bitten is twice shy as they say) so the company is on a sturdier footing once the mistake starts to be rectified.

3 Proven Strategies

Stock market investing can seem daunting because of it’s vast size (if for no other reason) and many people don’t even get off the ground let alone make it a viable option to create financial freedom for themselves. By breaking it down into bite size chunks I hope you can see that stock market investing is achievable for everyone. In this blog I have begun to describe to the strategy of dividend investing, following the up and coming companies and the good quality companies that have fallen from grace and are on the rebound. I will follow this up with much more detail about all three and add some new strategies for your consideration but for now I’ll leave it there. These strategies are used by individual and institutional investors worldwide to good effect. There’s no reason why you can’t use them too. I have now introduced one of the elements that make up the research centre I use called Stockopedia – The stock screen. Coming up in the next blog- A detailed view of my research tool – Stockopedia

Thank you Myles, this one has has my head spinning a bit more , need some me time to concentrate more !…. I’m sure I’ll have questions but best re read and try work it out better first 😊👍

No rush. The stock market is going nowhere but your knowledge is increasing day by day. Always happy to answer questions.