I find it quite ironic that in this day and age the only way to put a shirt on your back and food on the table is to earn income but in doing so the government takes a considerable chunk of it back in taxes. Income is taxed to death. What’s even more galling is that if you can squirrel some income away in a pension fund for your retirement (so that you have income when you can’t go out to work anymore), which by the way has already been taxed once, the government sees that pension income as income and they tax it again. And there’s nothing you can do about it. Or is there? In this blog, How to invest tax free in the stock market, I’m going to demonstrate that there is an alternative way to grow your wealth tax free, well almost tax free.

The problem with Income

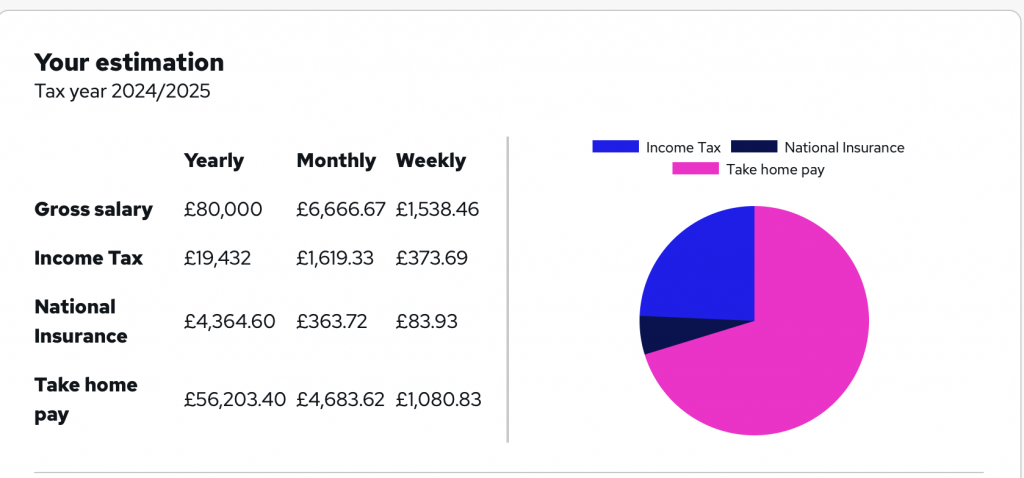

Plain and simple, if you don’t have assets that provide cash for your daily monetary requirements you have no choice but to go out into the workplace, sell your time and skills learned and earn income to provide for yourself and your family. The more you earn the more affluent you are able to live but the more you earn the more the government take off you in taxes. For instance, the tax and national insurance you will pay on an £80K salary is as follows.

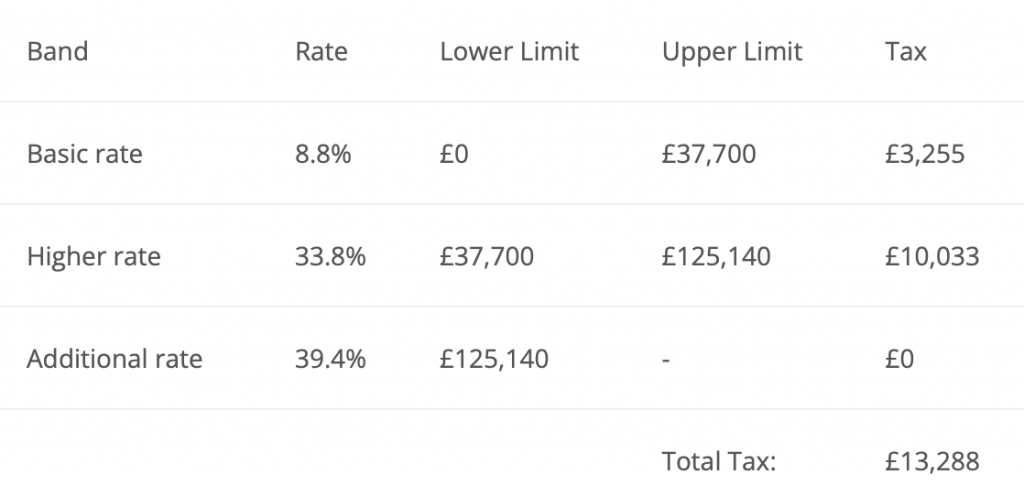

If you need £80K a year to fund your lifestyle and you earn all of it going to work you will pay £23,797 to the tax man in income tax and national insurance which equates to 29.74% of your earnings. Now let’s assume you have invested in the stock market and you are using the dividend strategy to earn income. You still need £80K to fund your lifestyle but you only earn £1000 in income and the other £79000 comes from dividends. Here’s the calculation.

You’re bringing in the same amount into the household coffers per annum but you are paying 50% (ish) less in income tax. This is how rich people work. They don’t declare a large income but fund their lifestyle much more efficiently using assets (ie- dividend income, rental property etc) because assets are taxed much more leniently than earned income. The tax the rich didn’t have to pay goes into buying more assets which in turn provides more income taxed at a much lower rate. You don’t need to be Einstein to extrapolate the compounding effect this has on their wealth. The rich get richer, the poor stay poorer and the middle classes get taxed to death as the saying goes.

Another example of how assets are taxed more leniently than income is how the government taxes Capital Gains. Let’s look at two scenarios.

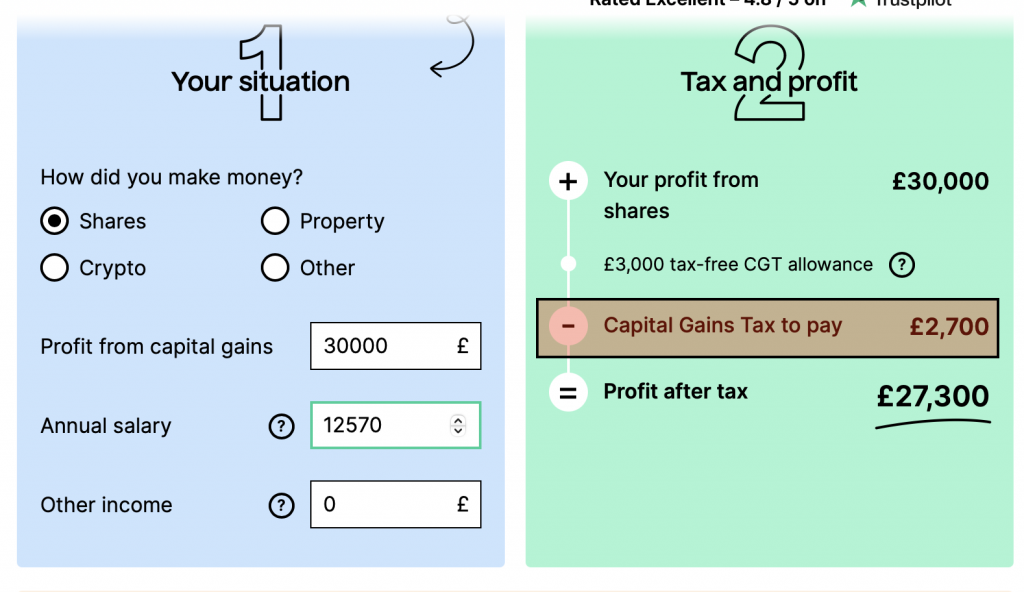

Scenario 1

You declare income up to your tax free allowance of £12, 570 and you make a profit selling an asset of £30,000. Here’s the calculation

Scenario 2

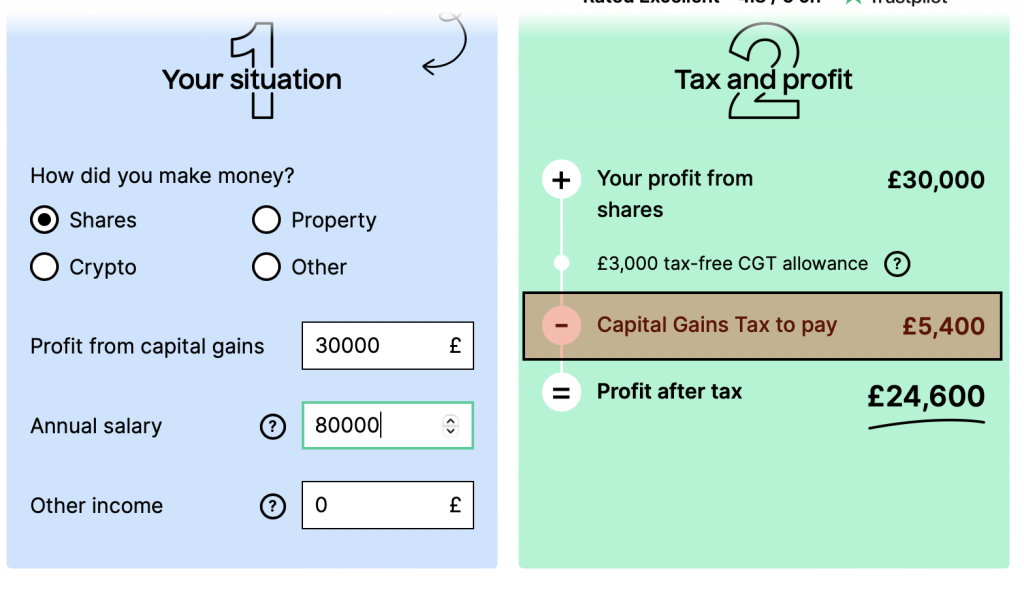

You declare earnings of £80,000 and you make a profit selling an asset of £30,000. Here’s the calculation.

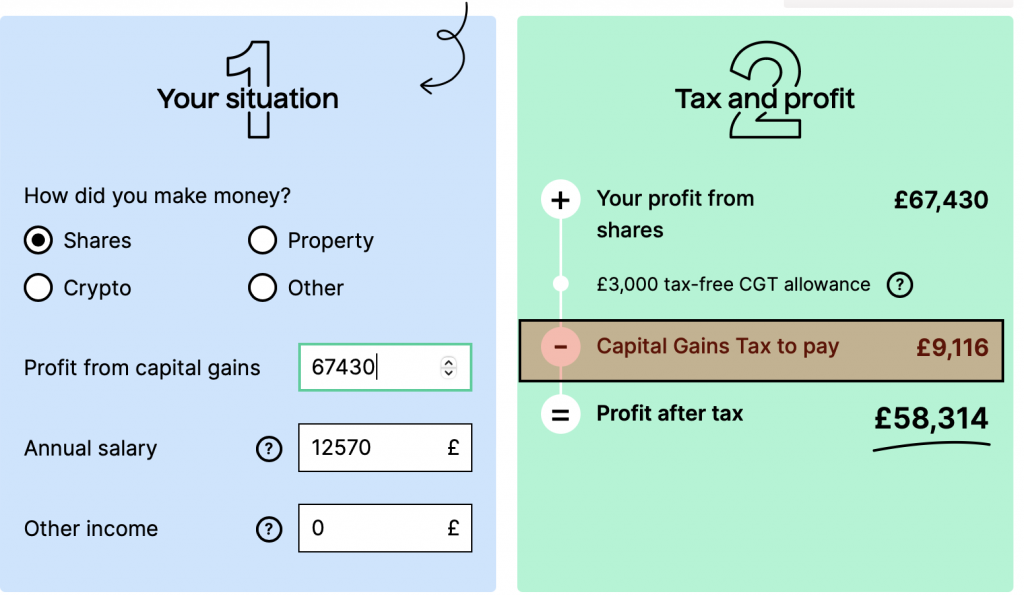

So, just by needing to earn £80K to ‘Pay the bills’ and you sell an asset and make £30,000 you will pay double in CGT than if you declared an annual salary of £12,570. (source). Having calculated your income tax liability (above), if you earn £80K a year you pay £29.74% in Income Tax and National Insurance. However, let’s look at how much tax and National Insurance you pay if you declared £12,570 in income and £67,430 in Capital Gains ( which makes up the £80K you need to live).

You pay zero income tax on your declared income of £12570 ( because that’s your tax free allowance) and you pay £9,116 on your capital gains of £67,430. You’re still bringing in £80k into the household but now your tax liability is 11.39%. ( £9116/£80000X100)

DON’T SHOOT ME, I’M JUST THE MESSENGER.

Take out an ISA

So, we’ve identified that by declaring a low income and making profit on assets reduces your tax liability by 18.35% but it gets better. There’s a thing in the UK called an ISA, an Individual Savings Account and you’ll never guess what? It’s completely tax free. Whatever capital gains you make and whatever dividend income you receive in an ISA is 100% yours. ZERO tax to pay when you take lump sums out unlike a pension which is tax free when it’s growing but as soon as you need to live off the cash MR TAX MAN wants another slice of your income.

Just one slight problem. You are only allowed to ‘INVEST’ £20,000 a year into an isa (£25,000 if you just invest in UK companies only (2024 Budget)) so it takes a while to build up the cash. The sooner you start, however, the quicker you arrive at a substantial investment pot in a tax free wrapper all thanks to HMRC (ie the tax man). Let the stressful tax ridden job go, generate income from different sources and enjoy life. You’ve only got one shot.

How to invest tax free in the stock market: Conclusion

CAVEAT: I am not a tax advisor and neither do I offer investment advice. I merely scour the information readily available from the government to make informed decisions about how I structure my finances and based on what I have uncovered I made the change. In the next blog, Managing debt, I make the argument that there is good debt and bad debt based on the best piece of advice I didn’t ever receive. See you there. DOUBLE CAVEAT ( UK only, but do your homework, there may be similar tax structures in your country)

Another excellent blog Myles! Learned a great deal about tax and dividend strategy here!

Thanks. I’ve been doing this since 2019 and my ISA’s are building nicely.