In this blog ‘Stock market psychology’ I’m going to talk about the reasons why investing in stocks and shares is a great way to build wealth just by understanding a bit more about the creatures that built and work the system called the stock market; Humans – you and me. You’d think the with all those Harvard degrees and all that wealth of knowledge the stock market would run like clockwork; share prices would be stable and volatility had no place but it’s the complete opposite. Let’s delve into the mind of the human being to find out more.

Stock market psychology: A brief history of Humans

I think we’ve done rather well don’t you? We jumped out of trees, weathered the dark ages, harnessed the power of electricity, flown to the moon and built a digital highway connecting almost everyone on the planet. That’s not too shabby is it? So how can it be possible for the stock market to be so volatile? Why are there booms and busts? Why are shares cheap one day and overpriced the next? Take a look this picture

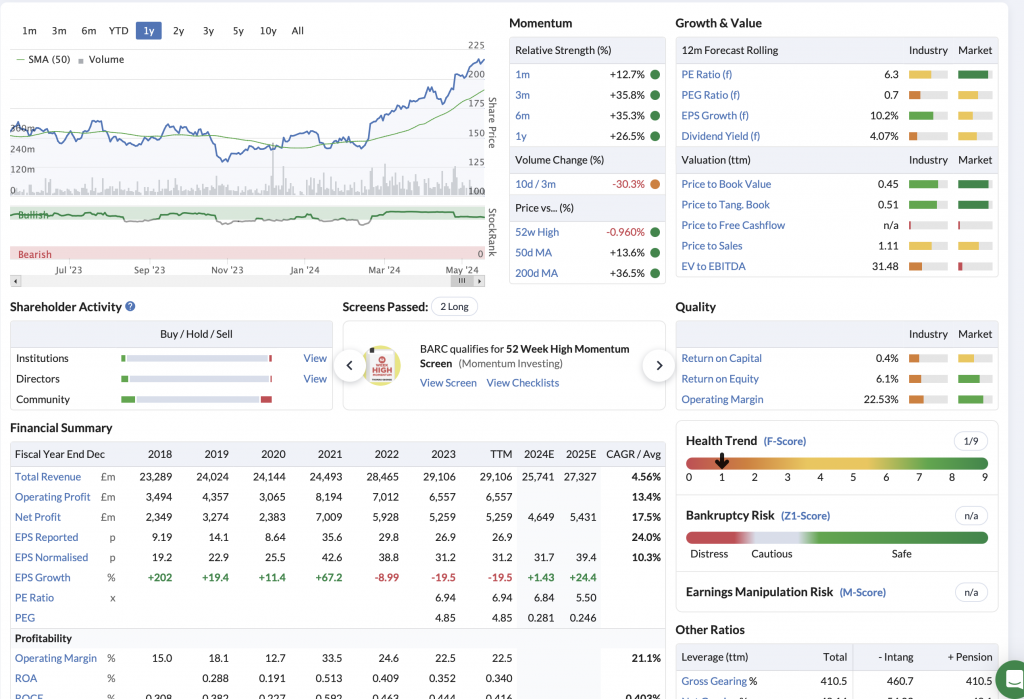

This is part of the Stockopedia stock sheet for Barclays Bank. On here, you will find every conceivable piece of financial and accounting information you need to make an informed decision about investing your money in Barclays. If you wanted to find this information out even as recently as the 90’s, it would have been an arduous task of visiting libraries and wading through journals and almanacs of published data but it’s all here on one page in a website delivered to your desk on a 15 minute delayed timetable so ask yourself this question. If it’s so easy to find all this information in one place and you don’t you need any more information why isn’t everyone making tons and tons of money? With all that intelligent firepower and superior (to most) education why does Freddie Fund make (on average) no more than 9-10% on your money? There’s clearly more to stock market investing success than meets the eye and THAT is human psychology.

Books and books, in fact whole libraries of books have been written on the subject of human behaviour in all walks of life and none more so than in the field of investing. Let’s take a look at some behavioural traits we all possess and how they impact the financial and investing world.

Disaster myopia and stock market crash’s

‘Disaster myopia’ was coined by economists Guttentag and Herring as a cognitive blindness to learn from past crises and downplay a future event happening based on what you are doing today. It doesn’t happen to me and It’s different this time are phrases that hint of disaster myopia setting in.

Who remembers this event? In 97 we gave back Hong Kong to the Chinese which signalled a very big shift in world power. The Chinese were going capitalism and boy did they. In a very short space of time they became a powerhouse of economic prosperity and in doing so they flooded western financial markets with cheap money and western banks couldn’t get enough. In 2001 I went to the bank to ask for a very big mortgage and because it was so big I asked for a fixed rate which was met with puzzlement. I had to explain that in 1989 I bought my first house and lost 35% in the ensuing crash six months later. ‘Oh, we’ve learned from our lessons, that won’t happen again’ was the response.

It seems I wasn’t the only one receiving easy money. The banks were packaging up 120% no deposit mortgages and selling them to anyone who walked into the branch irrespective of whether they could afford the repayment or not. Oh, the extra 20% was so you could carpet and furnish the place, buy yourself a car and have a nice little holiday (vacation) to boot. Oh and there’s more. What we’ll do for you as well is give you two years interest free. And then they bundled these (destined to default) mortgages with proper investments and sold them off as ‘A grade’ investment products and made billions in the process. Et Voilá, Global Financial Meltdown in 2008 as the shitstorm started to unravel. Now there’s dumb, stupid and downright lobotomised retardicity. I think you know where I stand. Disaster myopia doesn’t just apply to individuals however, it also creeps into whole organisations which is why we will always have boom and bust scenarios. All we have to do is wait for the next one, have a little cash spare and profit from someone else’s stupidity.

Confirmation Bias and compounding the error

This one is a corker. Confirmation Bias describes how humans sometimes process information in an illogical and biased manner. Once we have made an opinion about something it is very difficult to unthink your opinion even under irrefutable evidence to the contrary. What’s the phrase? “You can’t put a round peg in a square hole” but confirmation bias says you can. Who can relate? I certainly can. Even though the figures were glaringly obvious I continued running a business that was never going to make profit, almost killing myself in the process.

Confirmation bias in the investing world is seeking out information that supports a belief about a company or sector however small and in the process ignoring some more important information pertinent to a good quality decision. Click here for more info. Confirmation bias is very subtle and can be difficult to spot but here are some instances where it might be creeping in

- Having a strong emotional reaction to information (positive or negative) that confirms your beliefs, while remaining relatively unaffected by information that doesn’t.

- Relying on stereotypes or personal biases when assessing information.

- Only seeking out information that confirms your beliefs and ignoring or discrediting information that doesn’t support them.

- Looking for evidence that confirms what you already think is true, rather than considering all of the evidence available.

Confirmation Bias is the inability to look at something from an objective viewpoint. Another confirmation bias moment for me was buying Persimmon a few years ago at £24 a share. I needed a dividend paying company in my portfolio and Persimmon had dropped from £28.00. My checklist was sound

- Was it increasing sales – yes

- Was it making profit – yes

- Was its dividend increasing – yes

- Was it cash positive – yes etc…

Everything was positive across the board. However, I failed to take into account that housing is a cyclical sector. Interest rates, inflation and cost of living expenses were rising, so too were mortgage rates. Persimmon dropped to £7 a share so I bought some more and now I’m evens. Will it be a good investment in the future? I believe so. Was it a good decision to buy Persimmon when I did? Absolutely not. As the late great Charlie Munger commented:

Successful investing is not about admiring your winners but about how you scramble out of your mistakes

Charlie Munger

Understanding that confirmation bias exists helps you eradicate future mistakes and stops you from compounding the error.

Social anxiety disorder – fear of public humiliation

Arguably, the one of the biggest psychological flaws that holds us all back. What’s the phrase? Success is on the other side of fear and fear of public humiliation is so subtle that we don’t even know it exists. Essentially we are a pack animal and as such we group together for protection and social interaction to name a couple of reasons. Socially, financially, religiously and morally we have to fit into the group otherwise the group becomes judge, jury and executioner. They can’t handle you becoming more successful than they are so they try and bring you back in line. The hierarchy must be maintained so any failed attempt to better yourself will be dealt with public humiliation and who wants that right?

We keep up with the Jones’ to not be different. Same holiday destinations, vehicle changing every two years, buying designer clothes because it’s the trend. We get pigeon-holed.

Many moons ago I worked in an office with three other people and the company split us up into social groups and gave us tasks to do. One month we were given £10,000 in Monopoly money and we were told to see how much we could make in a fake stock market portfolio. I ploughed my teams money all on Abbey National and for the first two weeks it tanked. I was mocked and ridiculed mercilessly. However, two weeks in Abbey started to rise and the mocking and redicule turned into bitchy, snide remarks to the point where I had to point out to them how they were behaving. ‘That’, said my boss, ‘is called Tall poppy cutting‘.

Tall poppy cutting is a psychological process of keeping the herd together and it has many guises. Just throwing FUD ( fear, uncertainty and doubt) at someone is a very powerful means of manipulating behaviour. It is a lot easier to stay within the ranks and avoid public humiliation than it is to upset the apple cart.

FOMO – Fear of missing out

Closely linked to Fear of public humiliation is FOMO- Fear of missing out. Using FOMO is a marketeers dream tool. `They use FOMO to get you to buy stuff; stuff you really don’t need but because everyone else has one you don’t want to be left behind. The latest TV, nike shoes, the latest iPhone- the list is endless and it redirects your cash away from your investment portfolio; you know – that portfolio that generates income streams while you sleep. It is very powerful because you don’t want to stand out due to the fear of public humiliation if you haven’t bought the latest Ouijameflip or didgeridoo. It is also another reason why you get stock market and housing bubbles. Here’s my story.

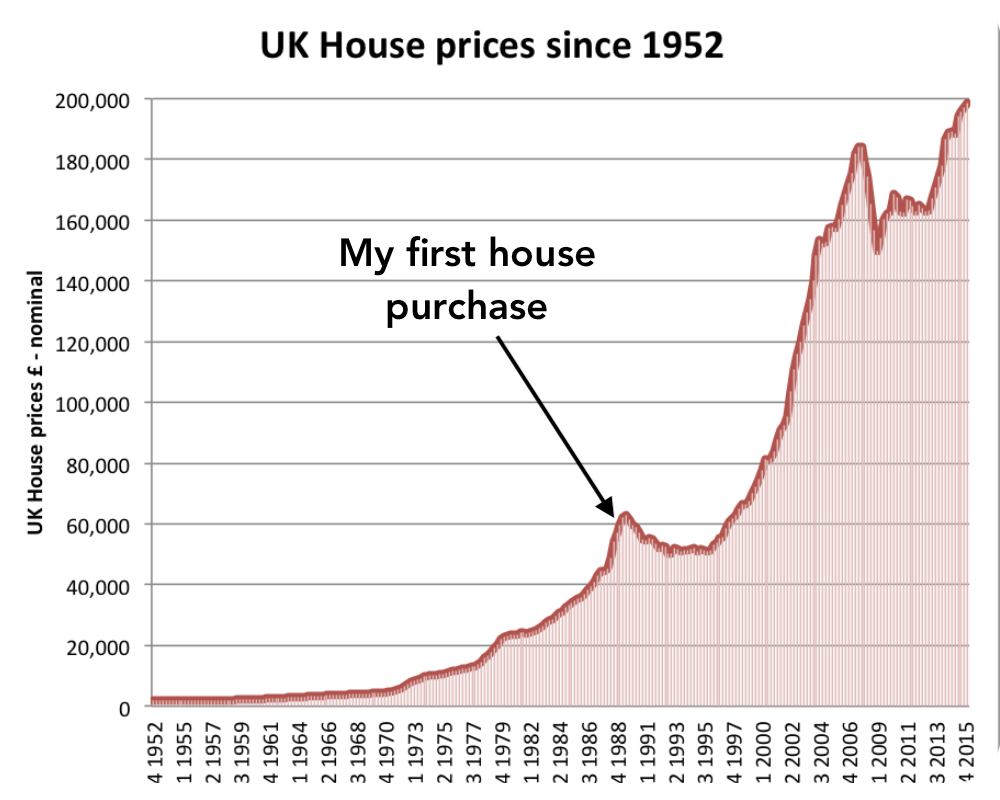

‘Get on the housing market Mylesy, quick. House prices are gonna keep going up. You’ll lose out if you don’t buy now’. As a 22 year old I was bombarded with advice from parents, friends, bosses. It was relentless but at the time I thought to myself somethings not right here, these prices seem a bit high to me but because of FOMO and Fear of public humiliation, we got the deposit together and proudly bought our first home as a newly married couple. Six months later we were in negative equity to the sum of 35%. I didn’t realise it at the time but that was my first lesson in investing. FOMO and it was very expensive.

In stock market terms we have a very recent example of FOMO – The dot.com bubble of 2000. My goodness me. Ridiculously experienced and highly intelligent Fund Managers, venture capitalists and private investors ploughed gazillions into company’s with no product, no sales, Nothing. Nothing except for a dot.com website and a floored business model. That is the power of FOMO if left unchecked. Knowing that FOMO exists allows us to wait for it to present itself, wait for the inevitable and buy in to good quality companies at bargain prices.

Ego and the stomach

No, it’s not the latest punk band, it’s the cause of all our poor decision making. Essentially, all humans are ego-driven creatures from the moment we are born. Ego is a persons sense of their own worth or self esteem. It is your identity. We need ego. On the positive side, a healthy ego creates self confidence, an inner peace, a security of identity and self belief. However it also creates a protective barrier to anything detrimental to ‘self’ which is where we encounter problems and which is why we can’t admit we are wrong. It is very uncomfortable for us to admit our flaws both to ourselves and to others (fear of public humiliation) so ego takes control and uses deflection tactics to preserve our inner peace by refusing to admit a mistake has been made or worse still by blaming others; passing the buck as it were. In stock market investing it is far easier to blame the analyst who wrote the glowing report on international woo woo that turned out to be a turkey than to blame yourself for not doing due diligence or following your checklist.

For me anyway, controlling your ego is as important if not more important to making better decisions in life than anything else. Eat humble pie and shout out loud ‘I made a mistake’. Nobody else’s fault but my own. In his book, One up on Wall Street, Peter Lynch describes it differently but essentially it’s the same thing. He says you don’t need to be highly intelligent or have qualifications in X,Y or Z but you need to have the stomach. The ego will always be on your side and doesn’t want you to make mistakes so when it sees your hard earned cash going down it initiates panic signals creating poor decision making at that moment in time. The stomach in this instance is the process of suppressing ego and letting the rational part of your brain take control of the situation. This process does not come naturally but it can be developed. The more time you devote to investing the more you can develop ‘Thick Skin’ when things aren’t going as planned which in turn puts ego in its place.

Stock market psychology – Conclusion

Controlling oneself is just as important as understanding a company’s financials or its growth potential. Just by understanding that all these psychological myopia’s and syndromes are built into each and every one of us has helped me understand myself a little better which in turn has created much more stable returns in the stock market. It’s nice to know you (I’m talking to my ego) LOL. I now put these into my buying checklist to make sure that disaster myopia isn’t setting in or I’m not being sucked into FOMO or Confirmation bias. How does this help us be better investors? Well, if it’s happening to us it’s happening to them and they are too busy to realise. In the next blog, I’m going to explain Stock market investing and Taxation and it’s not that boring, honest. In fact, it’ll make your blood boil. But for now I’m going to leave you with a famous quote by Ben Graham, the grandfather of modern investing.

The investor’s chief problem, and even his worst enemy, is likely to be himself

Ben Graham

0 Comments