“No wise pilot, no matter how great their talent, fails to use their checklist” was Charlie Munger’s famous quote that he applied to his investing philosophy. It doesn’t matter how many hours of flying time, pilots never take off without using the checklist. In this blog when do you buy: What you need to know, I will outline the basic questions (for each strategy (Dividend, Growth and Turnaround)) you need to ask when deciding on investing in a particular company so you can create your own checklists for better investing performance.

When do you buy? The dividend strategy

When you buy a Government bond, it does exactly what it says on the tin. A 10yr5% bond will pay you 5% on your money each year guaranteed for 10 years after which the government give you back your capital. The same cannot be said for dividend income investing. Each year the C-squad sit down and discuss what dividend (if any) to offer the shareholders based on how well the company has done over the last financial period so we have to ask as many questions possible to protect our capital so let’s dive in and take a look at what we should be asking.

Dividend Strategy Checklist

- Does the dividend being offered beat the bank interest rate. 1st rule of investing is can you beat the bank?

- Is the dividend cover over 1.5. This is the amount of cash the company has to keep paying the dividend. 1.5 is a general rule of thumb.

- Is there a history of the dividend being paid (dividend streak). The longer the better

- Is there a history of increasing dividends (dividend growth). Again the longer the better

- Is the company’s debt levels stable or decreasing

- Is the current ratio and quick ratio over 2 (ability to pay short term debt (within 1 year))

- Are sales and net profits increasing

- Is the product the company sells going to be needed 10/20 years from now

- Does the company command a market share (brand, patents, customer loyalty)

- Has the company’s share price taken a dip recently. Always better to buy when Mr Market offers you a lower price.

If all these questions return a positive outcome you can be fairly sure your capital is safe (as safe as it can be) and the dividends you require will be offered in years to come. Unfortunately, at the time of writing, the covid outbreak made all the dividend paying companies run for the hills and they didn’t pay a dividend that year. This has skewed the dividend streak and growth figures so more investigation is needed. I look at the dividend history building up to 2020 to get a sense of what the company’s dividend policy was and make a judgement call based on what I find. A cautionary note; double digit dividends are difficult to maintain and erratic dividend payments are not welcomed by Freddie and his cronies so a 10% dividend payment this year might be appealing but a drop in dividend to 8% (which is still great) will have a negative impact on the share price. Much better to look at companies that are in the 6% area and have a dividend growth streak going back 5-10 years.

When do you buy: The turnaround strategy

The key to success in the turnaround strategy is understanding the reason for the fall from grace. In addition to all the questions in the dividend strategy (except for the specific questions pertinent to the dividend), you need to add the following;

Turnaround Strategy Checklist

- Is the problem with the company a temporary set back or more permanent

- Is the competition stronger. Use stockopedia to make comparisons

- Have there been accounting irregularities

- Are sales/profits reducing

- What are the reasons for reducing sales/profits

- Has Mr Market overreacted

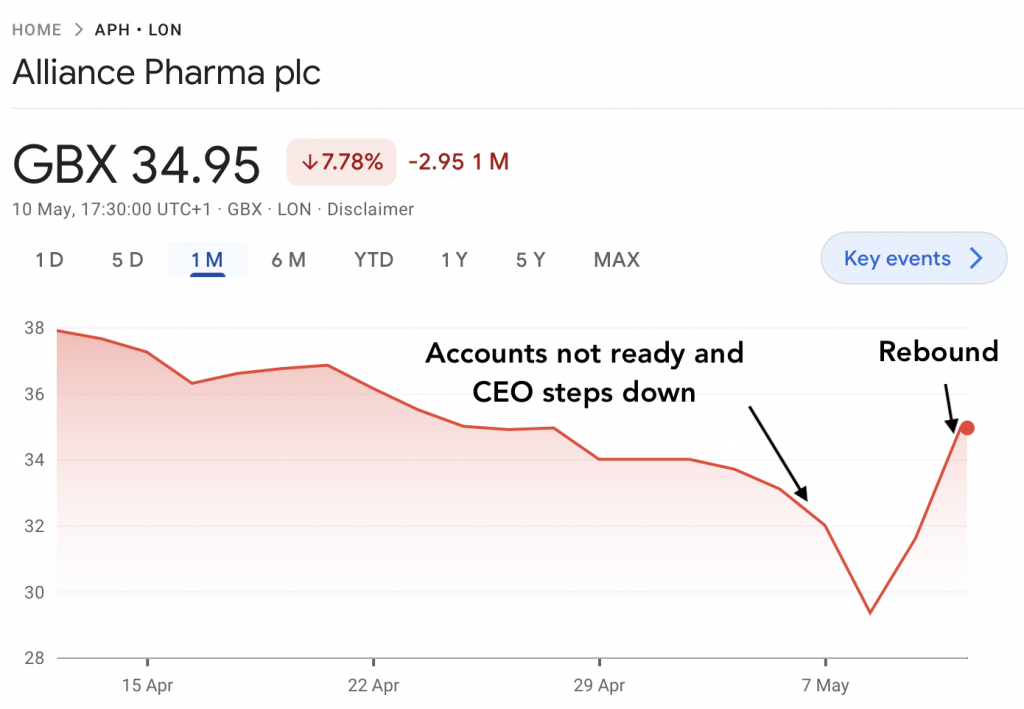

One such turnaround opportunity I’m invested in is Alliance Pharma. Having done my research my opinion is that the fundamentals are good and they’ve been reprimanded for being naughty. Mr Market has reacted badly to the news. Whether the case is acquitted or not remains to be seen but the CEO has now stepped down, a new guy is now in charge and it’s full steam ahead. Patience is the key with this strategy. I haven’t bought at the bottom and I am currently in the red so I have to wait for the change to happen.

When they start off, companies are lean, mean and keen but as they grow they get bloated, sluggish and inefficient. Mis-management is in play. Freddie Fund cannot afford to have these companies on his books and as there are leaner, more efficient companies coming up fast so a big sell off occurs. Members of the the C-squad are replaced and the maschete wields its power as layer upon layer of middle management paychecks are sliced to boost profit margins. My first 6 years of working life was in the corporate insurance world and I witnessed it many times. Aviva and Vodafone are two such companies that have just gone through the process. Now we wait to see how effective the cull will be.

When do you buy? The Growth strategy

I see companies like boats. You’ve got the big humongous ones that can ride the waves but are slow , cumbersome and boring but deliver a steady load, then you’ve got the speed boats that are fast, nippy exciting to be in but easy to sink in a storm. Growth companies are a bit like speed boats. Great to be around in calm waters but keep your eye on the horizon. In addition to the questions from the dividend strategy relating to product quality, debt management, stability etc the growth strategy checklist needs to have a few extra questions added to it.

Growth Strategy Checklist

- Is the product protected. Where is the economic moat

- How fast are they growing compared to the market. Too fast may cause cash flow problems

- How big is the market they are trying to grow into

- Is the competition better placed to take a market share

- Is the P/E ratio over 15. You may be paying too much for the potential of future profits (TESLA. P/E ratio is 45)

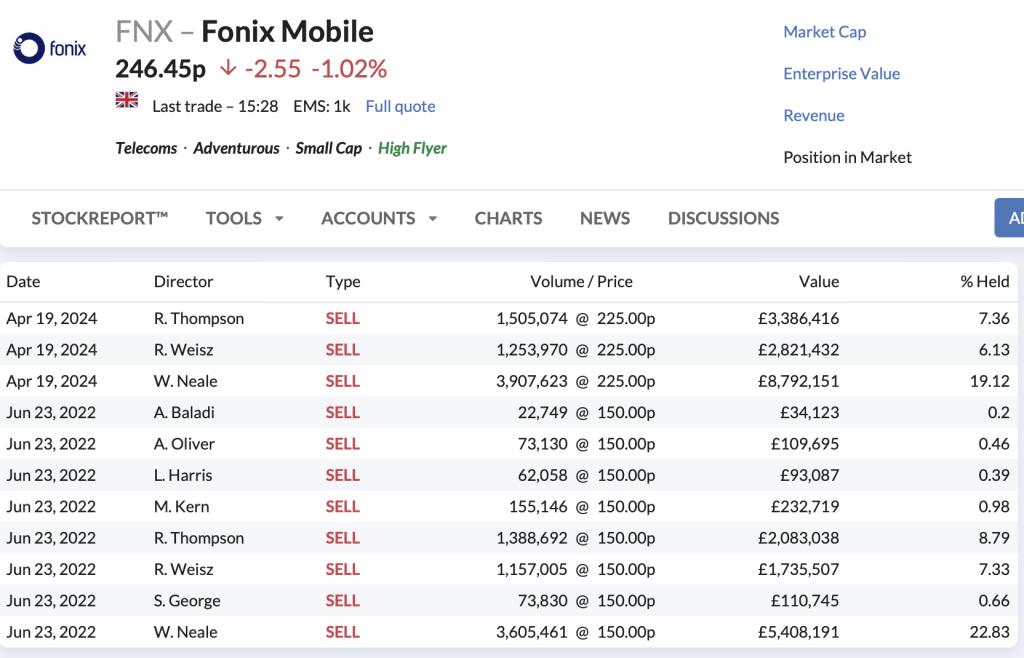

For me anyway, the growth strategy is the most precarious because the unpredictable can happen but it’s also the most exciting. Nothing nicer that waking up one morning and your share price has rocketed on the back of speculative or actual take-over news. One such company I’m watching is Fonix mobile. Its share price has risen 23% in 12 months.

Sales and profits have been increasing since 2018, it has a cash surplus of 29 mil (no debt) and its stockopedia quality value is up at 99 so why the big sell off? But more importantly they provide a digital payment system. On the down side there are plenty of digital payment systems out there ( stripe, PayPal, Apple Pay) so where’s the economic moat? But on the up side it could be a great acquisition. Yes I could have made a very nice profit on this one but ALWAYS safety first.

When do you buy?- Conclusion

I hope you will have noticed that there are recurring questions that apply to all strategies and I also hope that you’ve noticed that these questions aren’t rocket science and that they apply to your personal finances as much as companies. Have a product you can protect (your job), control your debt (don’t pay your mortgage and the bank will repossess) and can you grow (increase your salary ie:your career). Build your checklists, use them and if a red flag shows up just remember that it’s ALWAYS safety first even if you miss a nice little opportunity.

In my next blog, Human Psychology behind Stock market investing, I explore how human behaviour affects stock market performance. It’s a cracker, see you then.

0 Comments