In my blog 3 proven strategies: mastering the art of stock market investing, I I discussed 3 strategies that investors use worldwide to make profits in the stock market. In this blog The Dividend Strategy: Everything you need to know, Im going to add some meat to the bones and cover the dividend income strategy in full.

When companies become large enough they distribute some of the profits back to the shareholders in the form of a dividend – a cash sum paid to each shareholder in two payments annually (usually). There is an interim payment and a final payment and both payments added together create the dividend yield. In addition, if a company has a particularly bumper year, the directors may decide to award a SPECIAL dividend as a one off payment. There are three dates you need to know about when buying dividend yielding shares

The Dividend Strategy: The three important dates.

The first date is the DECLARATION DATE. During the Annual General Meeting, each company agrees upon how much of the companies profits are to be distributed to shareholders. This information has to be declared to the Stock Exchange for public information. The second date is the EX_DIVIDEND DATE. If you own shares on this date you will be eligible to receive the dividend payment on the PAYMENT DATE which is the third date you need to be aware of. The payment date is when a cash payment is paid into your share dealing account. The declaration date is usually abut three weeks before the Ex-dividend date and the ex-dividend date is usually about three weeks to a month before the payment date. I say usually because every company can declare their own timescales so this is just a rule of thumb.

Now, this is where it gets interesting. If the Ex-dividend date is declared on the 11th May 2024 and you own shares when the stock market opens at 8AM, you can immediately sell those shares and still receive the dividend payment on the payment date. You may have held the shares for a whole year but if you sell the shares on the 10th May ( the day before the ex-dividend date, you will NOT be eligible for the dividend. Don’t ask me why, I haven’t got a clue. Them’s the rules.

The dividend strategy: What happens next?

Pension funds and fund managers love dividends. It’s a great way to add huge sums of cash to the pot and thereby keep their jobs and ultimately their lifestyles safe and sound. Let’s take a look at a recent dividend announcement by Kenmare resources. On 20th March they announced their upcoming dividend yield of £.0385p per share which must have delighted Freddie and his cronies over at Pensions R Us because as we can see from the chart they all started buying to take advantage of the cash payout. They were so enthusiastic the share price went up a whopping 15.29% in 3 weeks.

For those beady eyed of you, you will have noticed that as soon as the ex-dividend date had been reached there was a big sell off (because all they wanted was the dividend) and usually if the share price rises by 7%, say, the sell off brings the price down by the same amount on ex-div date. As the sell off began before the ex-div date I can only assume that because the dividend announcement was so good shares were over purchased and people thought, heck I don’t need the dividend, I’ll just cash out the day before but then I would be guessing, I don’t know. However a 15.29% gain in 3 weeks is rather tempting to take so it wouldn’t surprise me if that’s what’s happened here.

Dividends vs Bonds: What’s the difference

Both Dividends and Bonds offer the same thing; A cash return on your investment. A government bond is a certificate issued by the government to borrow your money for a period of time (in this case 10 years) for a guaranteed annual return of 5%. At the end of the period they give you your money back. Dividends do the same thing and more often than not pay more than bonds but, and here’s the rub, they are NOT guaranteed. Dividends are at the discretion of the management each year depending on how well the company has done. So we need additional layers of protection for our capital.

The stock screen: Dividend streak; Dividend growth streak

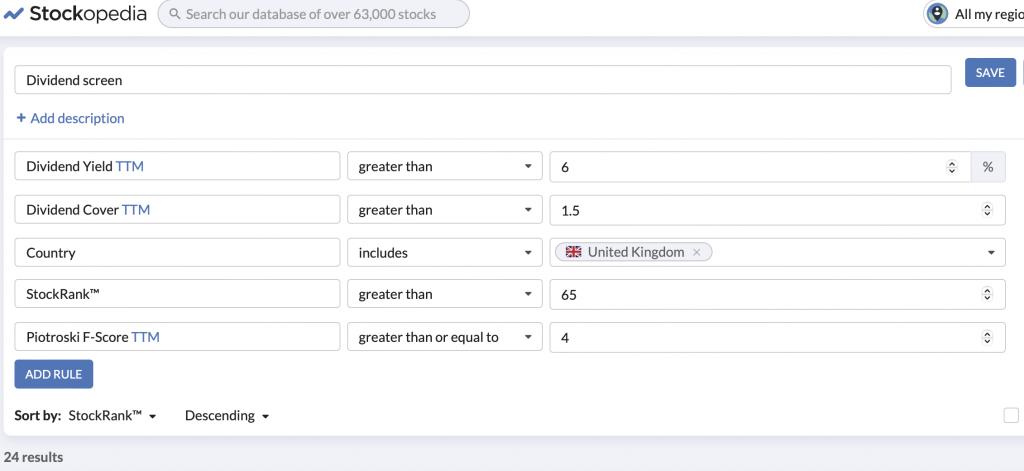

Below is a very simple screen that I created in Stockopedia to filter out all companies within a certain criteria range.

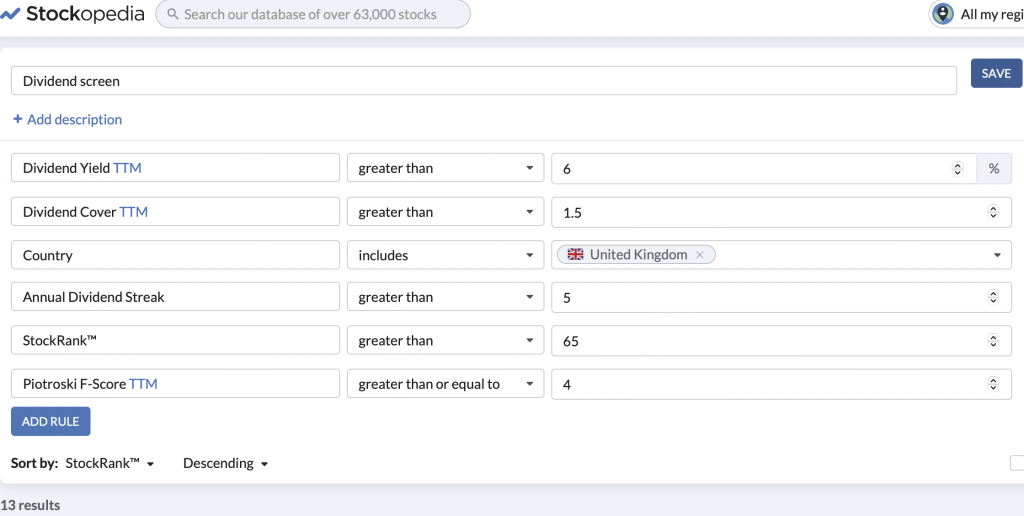

I want to look for companies with a dividend yield greater than 6, a dividend cover of more than 1.5 (div cover is the amount of cash a company has to continue paying dividends in the future. above 1.5 is a rule of thumb), I want them to be in the UK with a stock rank of over 65 and a health trend of over 4. This screens has returned 24 companies for me to delve into. There are two more rules I can add that enhance the protection of my capital. DIVIDEND STREAK and DIVIDEND GROWTH STREAK. Dividend streak is the amount of consecutive dividends a company has paid out in the last 10 years and Dividend growth streak is the amount of consecutively increasing dividends (YOY) a company has paid out over the last 10 years. Here is a screen with dividend streak added.

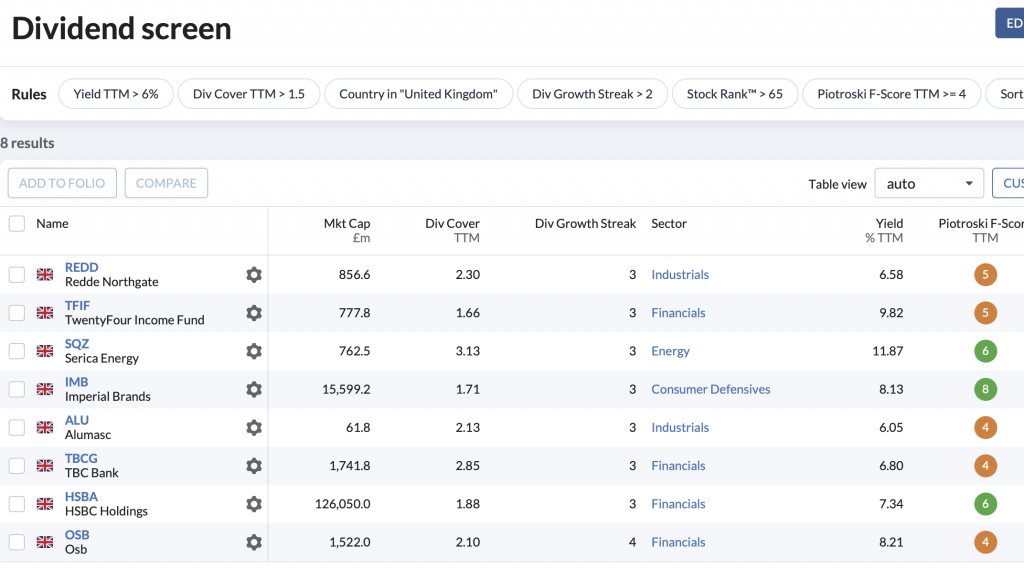

The results have now dropped to 13 companies. There are 13 companies listed on the London stock market that have offered a dividend consecutively for the last 5 years in the last 10. Let’s swap out the streak rule and add in the growth streak rule and see what we get.

So now we have a list of 8 companies that have offered a consecutively increasing dividend over the last 2 years. These two rules offer the investor a degree of safety because they represent companies that are financially stable enough to keep paying a dividend year on year which is what we are looking for.

There is however a slight problem with these two rules at the moment. During covid most companies stopped paying dividends because they had no idea how bad covid was going to become. This has cocked up the screen because no one paid a dividend in 2020 so I leave these two rules out of my screen for now but will add them back in in a few years time just to give companies a chance to build up a dividend history for me to analyse.

Imagine those two rules with a greater than 7/8 year streak and returning some results. What you will have found are companies that have not only have consistently delivered dividend to shareholders for 7/8 straight years but also have increased the percentage yield annually as well. For a dividend investor those companies are gold dust.

The dividend strategy: On a per share basis

Let’s say you bought 10,000 shares in Wigwams Inc at a price of £1 per share. The dividend yield is a whopping 10% and all other factors added up so you thought happy days I’m in. Freddie fund and Tracy Trader have done their best all year and on ex-div date the share price is down to 0.75p a share. So do you then receive only £750 in dividend income? No, it doesn’t matter what the share price is on ex-div date, it matters how many shares you own in the company so as long as you haven’t sold any shares you will receive £1000 because you’ve still got 10,000 shares. Dividends are on a per share basis. Your share capital value may have gone down but you’re still receiving 10% on your original investment.

The dividend strategy: What do you do with your dividend

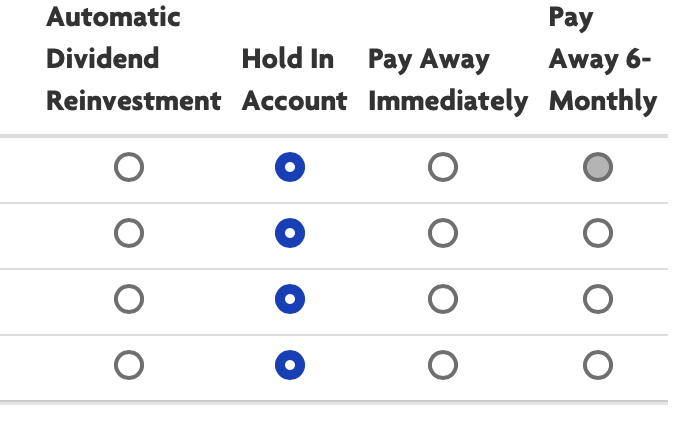

There are three things you can do with your dividend once you’ve received it.

- You can take the cash out and spend it if you need to boost your income.

- You can reinvest it back into more shares in Wigwam Inc. More shares means a bigger dividend next year.

- You can leave it in cash in your Broker account and look for another company to invest in.

As you can see from the image on the right, all these options are easily managed through your broker account so once you’ve setup your options, sit back and watch the cash roll in. These options are not set in stone so if you change your mind you can select another option and as long as you do this before the Ex-div date, your choice will be executed. My preferred option is to hold in account (as cash) because while I reinvest all my dividends, I like to wait for Freddie and Tracy to give me a cheap price. This may not be on the payment date.

The dividend strategy: One more piece of protection for your capital

Two years have gone by and Wigwam Inc’s share price has risen but only to 0.8p per share. Your original capital investment is annoyingly still £2000 down but you have received £2000 in dividend income which negates the share price drop. From this point onwards you are making money from your investment. You are not solely reliant on a share price increase to make your investment a profitable one. If Wigwam’s dividend policy is to continue to not only issue dividends but to increase dividends year on year, it would be very wise to reinvest your cash straight back into more shares of Wigwam. The more shares you have the bigger the dividend, the more shares you can buy, the ever increasing dividend. The Power of COMPOUNDING is building your wealth whilst you sleep.

The dividend strategy: Conclusion

You can stick to the dividend income strategy on it’s own or you can use it as part of a portfolio management strategy where you put 60% into dividend companies and the other 40% into growth companies. The dividend strategy is classed as a defensive strategy due to it’s built in layers of protection and is a great way to get your investing journey on it’s way but I do have a word of warning; It’s boring as hell. THERE’S NO ACTION. You buy the shares, then you wait 6 months for the company to announce what the dividend will be, you get all excited when the cash hits your account and then you wait another six months to do it all over again. No need to check the share price because the dividends are on a per share basis so it doesn’t matter if the share price has gone up or down. It’s a buy and forget investment. I do say that tongue in cheek, obviously because I fully endorse this type of investing. For a little more energy you could mix the dividend strategy with. say, the Turnaround strategy which I will talk about in the next blog.

0 Comments