Buying funds from a fund manager is a worldwide investment strategy and used by many to beat the bank’s returns. Whether it’s an index, mutual or hedge fund you buy a basket of investments tailored to the level of risk you are prepared to take. A low risk fund will have more Steady Eddie companies, government bonds and cash giving you a low rate of return and a high risk fund will have all the new fizz bang companies that may or may not go bust but could potentially provide a high rate of return. And there are, of course, thousands of funds in-between to choose from. In this blog I’m going to discuss why buying funds is not such a bad idea but also the constraints the fund manager’s have doing their jobs; Enter Freddie Fund.

What types of funds are there?

Funds come in many shapes and sizes but essentially they all try and do the same thing. They try andmake a return on the investment for their clients. Let’s discuss a few fund types here.

Index fund

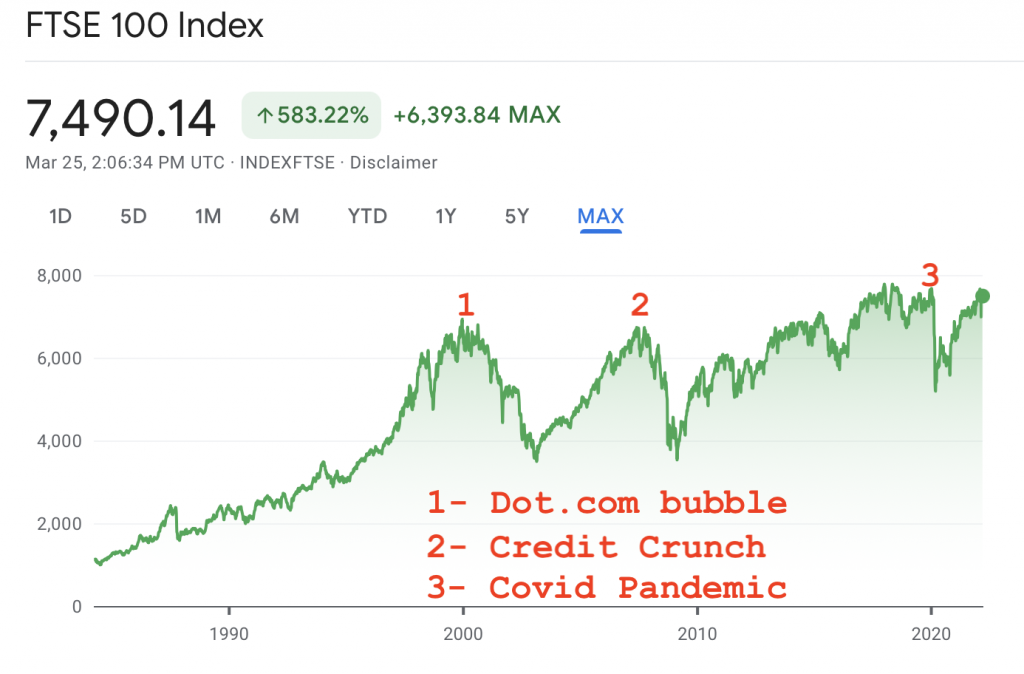

An index fund spreads the amount of your investment equally over all of the companies in the index. So, for instance, the FTSE100 index has the biggest 100 companies in it. If you invest £10K, £100 will be invested in each company. These are considered low cost funds because there are no management fees involved and over the last 25 years, UK index funds have returned annually 6.67% to the investor. They are a buy and forget investment as your cash just goes up and down with the stock market. Even though there have been stock market downturns during that period we can see from the chart the stock market trends upwards.

If you do nothing else but start your investing journey by buying index funds you won’t get rich but you will beat the bank rate and because it’s a buy and forget investment you can just let it grow and carry on going about your business until you need to cash it in. Obviously if you can let it compound over many years you can build a tidy sum.

Managed Fund

As the name suggests, buying funds from a fund manager means you are buying all the expertise that that manager, Freddie and the complete investment knowledge of the whole firm he works for, has built up over many years. An average fund manager ought to return to you an annual rate of between 9-10% (medium risk). Managed funds return more than an index fund because Freddie is buying and selling all the time to create the returns for you. The benefits should be self evident. All that experience, degree educated professional managers and analysts galore looking after your money, glossy annual reports and a 9-10% return which beats the bank rate. Go Freddie!

What’s the catch?

No catch. A 9-10% return on your money is well worth having. However, each fund (and there are thousands to choose from) comes with its own fee’s structure because all this expertise comes at a price. Obviously. All you have to do is pick your level of risk tolerance, work out what the fee structure is and what market sector you would like to invest in and let Freddie and his team do the rest. Here’s Freddie on the right. Handsome chap and looks like someone who knows what he is doing and you should leave all your investing decisions to him because he’s the professional, right. How can an individual investor like you and me compete with all that knowledge and firepower. Well, there are three very good reasons why it is not only possible but probable that we can do better than Freddie and in order to answer that I need to take you down the 1st fairway at Wentworth where two CEO’s have just tee’d off.

Every Sunday morning Steve and John two high net worth individuals love a game of golf but this Sunday is different. The previous day they both received their glossy portfolio report from their respective fund managers. Freddie is delighted with his performance and confidently highlights how good he is buy showing his client the growth in the fund. However, Tarquin, the other fund manager has out performed him by 1.5%. These types of people don’t like to be outdone by their peers so Steve is straight on the phone Monday morning giving Freddie a piece of his mind.

Freddie has expensive tastes. Freddie wears designer suits, drives expensive cars, has a huge mortgage because he has to live in the correct ‘POSTCODE’ area, has memberships to all the ‘IN’ clubs, educates his kids in expensive private schools and so do all his collegues. He is MAXED out and is trapped in the system. Freddie has a reputation and simply cannot afford to be adventurous with his stock picking. He needs that job to pay for his lifestyle

Creating and selling funds is a very lucrative business for these organisations for one simple reason. They don’t make the returns and then take their cut, they charge you up front before they’ve lifted a finger and then charge you annual management fee’s for the duration. Therefore they have to attract our two golfing buddies before anyone else does. Their reputations are of paramount importance to them.

Buying funds: Freddie’s dilemma

Freddie goes to work every day with one simple goal in mind. Don’t lose clients’ money. If he does that he risks the wrath of these high net worth individuals, his own reputation and therefore his lifestyle and the reputation of the Firm he works for. Now ask yourself this question. Do you think that Freddie is going to do great things in these funds or is he just going to do slightly above average because he doesn’t have to do ‘STELLAR’ to keep everyone happy? Exactly. This is the reason buying funds will only ever get you a 9-10% return most of the time but as I’ve said at the beginning as long as you’re beating the bank you’re money shouldn’t be in the bank, and Freddie and crew should certainly be able to do that.

Individual investors do not have those constraints. We can use TIME to our advantage and wait for opportunities to appear and we are only accountable to ourselves. This is the advantage we have over Freddie and why we can outperform him. There are no fees to pay so ALL your capital is invested.

Now, that’s Freddie in a nutshell, Let’s talk about Tracy. Tracy is a trader. in the next blog Stock market trading: What you need to know, I’m going to delve into the wonderful world of trading and how traders affect share prices.

0 Comments