Enter a room full of people and throw ‘The banking system – Friend or Foe’ onto the table for discussion and see what happens. I’m sure it’ll be as divisive a subject as politics or religion. But is it a source of good or evil? Let’s explore its purpose in society to find out more.

The banking system – Our Friend?

It can’t be denied that without it the world would be a poorer place. It has accumulated wealth and distributed it into worthwhile projects, businesses and charitable organisations worldwide. It lends money to governments to improve infrastructures; Schools, hospitals, road systems and sanitation systems amongst other things have been developed, updated and improved with the use of money lent by The Banking System.

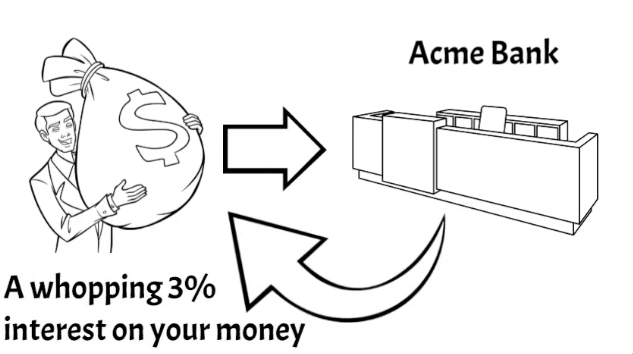

In addition, it offers individuals a safe haven to store their cash in GUARANTEED deposits and it also offers interest on those deposits as a goodwill gesture for leaving your money there. They have provided the individual the opportunity to purchase their own home via cheap home loans. They provide other forms of credit in the form of car loans, home improvement loans and credit cards for some extra cash making our lives more and more comfortable.

Hoorah for The Banking System, Right?

Maybe, maybe not. Let’s take a look at the flip side of the coin.

The Banking System – Our Foe?

I suppose one has to ask the question, ‘How did the banking system become so rich? All they do is offer you a safe place to store your cash instead of keeping it under the mattress. They even offer a small rate of interest to keep your money there. But the money doesn’t stay in the bank so what does the bank do with it?

If the bank can offer you 3% interest on your money, you bet your bottom dollar they are making more money elsewhere. But how do they do that? The answer is not that difficult to understand.

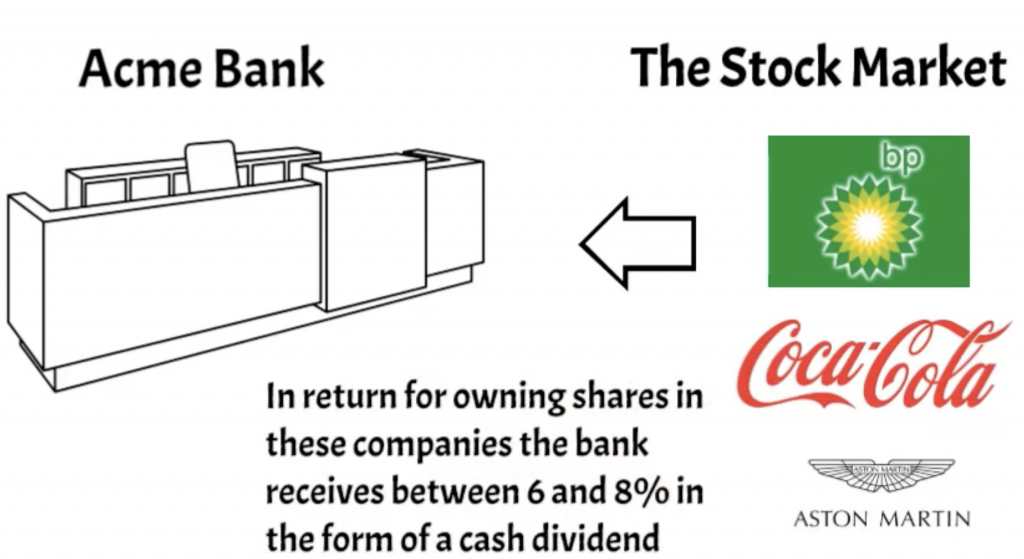

The Bank takes your money and buys shares in big companies that offer a cash bonus for owning their shares. This is called a dividend. The bigger and more cash rich the company the more is the annual dividend payout.

The bank, as promised, give you 3% on your deposits but they are making in excess of double that amount by simply buying shares in well known household branded companies like BP, Shell, Coca Cola etc.. WITH YOUR MONEY!! And just to add insult to injury, they offer you credit lines such as mortgages, credit cards, overdraft facilities etc with money they made from investing YOUR MONEY in the first place.

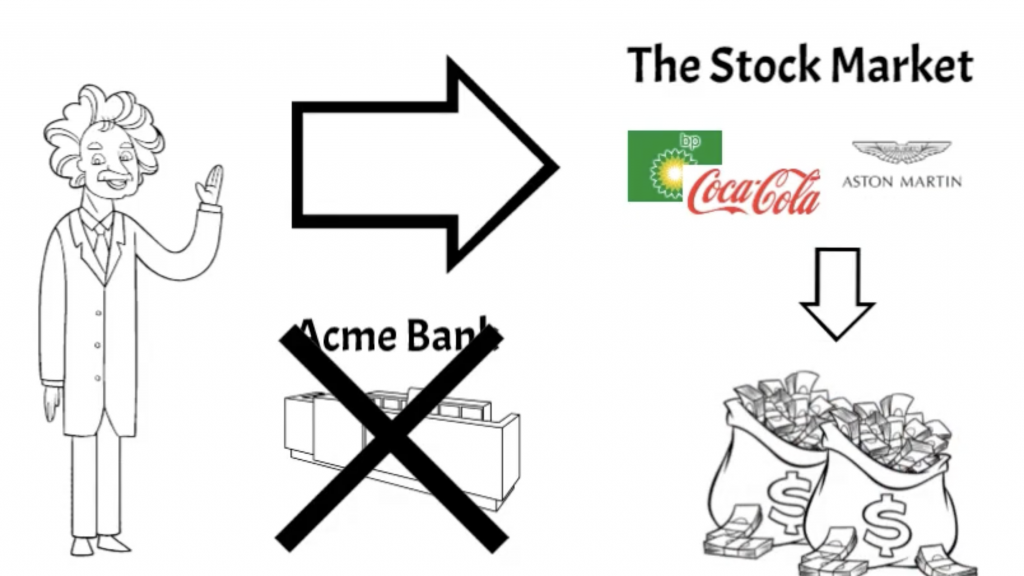

It doesn’t take Albert Einstein to work out that if you could find a way of investing directly in these companies yourself and bypassing the Banking System altogether, you’ve got a better chance of attaining financial freedom and the ability to release yourself from the rat race. There has to be a way, and there is.

The Banking System needs your deposits to make more money than it returns to you in order to keep growing richer and richer so it employs scare tactics to make you believe that your money is in the safest hands with them and that we as individuals cannot possibly understand the complexities of the Stock Market to make it profitable for us to invest directly. However, I am here to de-bunk the myths of the Stock Market and to prove that with the advent of the internet and using simple strategies, patience and a little knowledge, making good returns investing in stocks and shares is very achievable for all of us.

The Banking System- Friend or Foe?

I’ll let you decide but one thing to note. There isn’t a millionaire alive that made their fortunes by depositing their cash in the bank. Coming up in the next blog: A History of The Stock Market.

P.S. If you’re interested in the origins of the banking system click here. It’s a good read.

Your first piece of advice to me was….”beat the bank”. That is my mantra for investments. I’m no Warren Buffet but if I can succeed in this, I’m winning.