I’ve been sacked twice. Well, I say sacked, manoeuvred into a position where I had no choice but to leave and hand on heart on neither occasion did I deserve it. I have to take full blame however because I have a habit of thinking outside the box and it was one such occasion where I saw Prince William make a speech and I thought ‘What if Prince William doesn’t like public speaking? What if Prince William just wanted to be a plumber. And then I thought I wonder if you can be really good at your job but wealthier than your boss. I now have my answer. Losing your job when it pays for your lifestyle is extremely unpleasant and stressful so I had to find an alternative way of earning income. The book rich dad, poor dad by Robert Kiyosaki gave me the solution – Passive Investing. My life is now free of the shackles of other peoples jealousies and I’m enjoying every minute. In this blog I’m going to offer three reasons why you should start Passive Investing today.

But first, what is Passive Investing?

Passive investing as opposed to active investing is a process of doing up front research, waiting for the right opportunity to buy and them holding onto those investments for a long time. Active investing or trading involves continually buying and selling to make your profit and as the name suggests you are much more active so it requires much more time and effort. Passive investing on the other hand is a lot more hands off but just as effective in generating profits over the long term. So what are the three reasons to start passive investing?

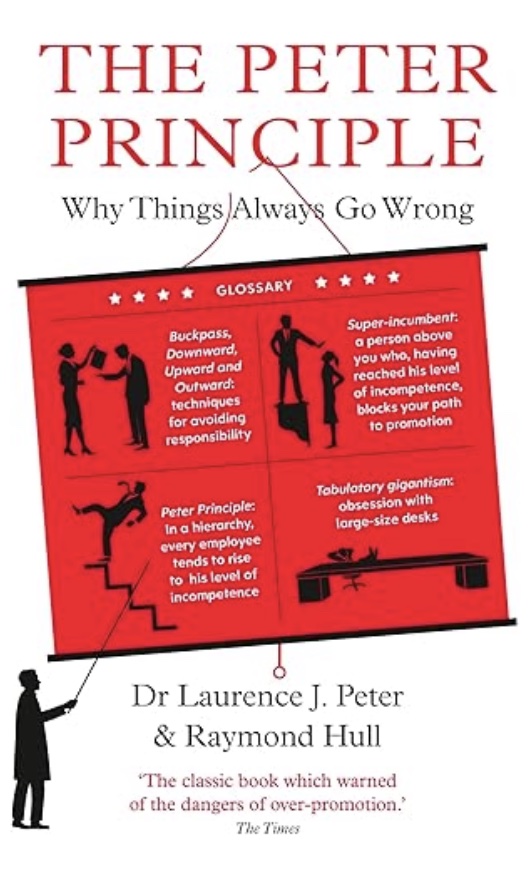

Passive investing reason 1: The Peter Principle

In his 1969 book of the same title, Lawrence J Peter offered a series of observations as to why things go wrong and within these observations he describes the concept or ‘Reaching your level of Incompetence’. Whether it’s the civil service, private conglomerates or the military you are promoted if you are competent at your job. You continue to be promoted until 1 day you are no longer promoted because you are not displaying the standard level of competence to be promoted. Therefore you have reached your level of incompetence. Do you go back to your level of competence? No, you stay where you are not doing a very good job and even more worrying is that you are aware of your failings so you try and mask them over because every time you are promoted you raise the levels of debt you service. You are trapped in the rat race. You can’t go back to your level of competence because of your debt levels and you can’t go forward because you have reached your level of incompetence. And everyone else in the organisation is in the same position, all needing that monthly pay check to survive.

You have no choice but to absorb not only your own problems but the problems of all your work collegues and your friends ( because they have work collegues too) who also work with and for collegues that have reached their level of incompetence and the only way to cope with all this is to call it a career. To me a career is just an envelope to put our ego’s in so that we can justify the importance of our existence.

Building a stock market portfolio releases you from this life by providing passive income without having to go to work. If, on the off chance, you actually enjoy what you are doing for a living and really enjoy Monday mornings consider this. What if one day, circumstances change. What if a bad apple enters your space who makes the job you love a living hell? Imagine having a passive income portfolio working for you in the background allowing you walk away and start afresh without a moment’s hesitation.

Passive Investing reason 2: The Millionaire lifestyle

Passsive investing can build you an income stream to protect you from the vagaries of the Peter principle, that’s reason no 1. If you want to go that one step further, investing in the stock market can propel you into the jetset lifestyle of the millionaire. This is reason no 2. Where else can you accumulate enough wealth to live this kind of life? You can win the lottery, you can steal it or you can be the next Bill Gates and build a multi million pound business.

The chances of you winning the lottery, being a successful thief or building the next Amazon is pretty remote but with the right mentality, time and understanding building wealth through a stock market portfolio is achievable to all of us. On three separate occasions now I have doubled my money. The only mistake I made was being too timid with my executions but I’ll be ready for the next opportunity.

The Power of compounding

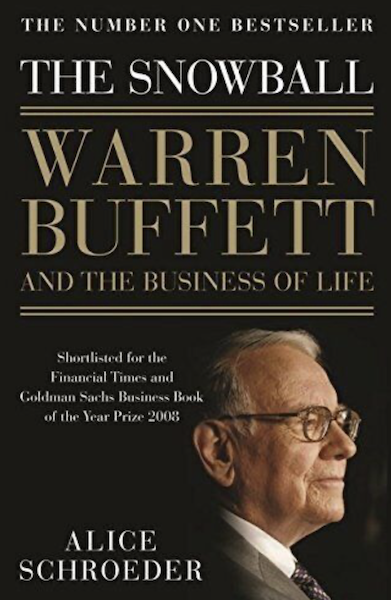

Albert Einstein called compounding the eighth wonder of the world. In his book, The Snowball, Warren Buffett describes how understanding compound interest and using its’ power can make you very wealthy over time and the concept is so simple a 10 year old can understand it. The snowball starts small but the more you reinvest the interest the bigger the snowball becomes. A pound today is worth more than a pound tomorrow. If you get a pound today you can invest it and get a return. Assume you get a return of 10% in a day. Tomorrow you will have £1.10. The earlier you start investing the longer you have to reinvest the returns you get back into your portfolio. Your wealth grows by earning interest on interest. It’s not that difficult to understand. All you need is discipline and time. Every pound you put into your portfolio is an investment in your future self. Consider it as spent money, the same way the cost of a holiday is spent money. If you don’t touch it and leave it to grow it will serve you well down the line. This book was the first I ever read and it’s great. Get a copy here.

Passive Investing reason 3: Building your legacy

If, like me, you have come to this activity in the latter years of your life you may be thinking what’s the point starting now? I won’t live long enough to make a huge difference. Well, Let me tell you about Cliff, the £3000 commission and sudoku.

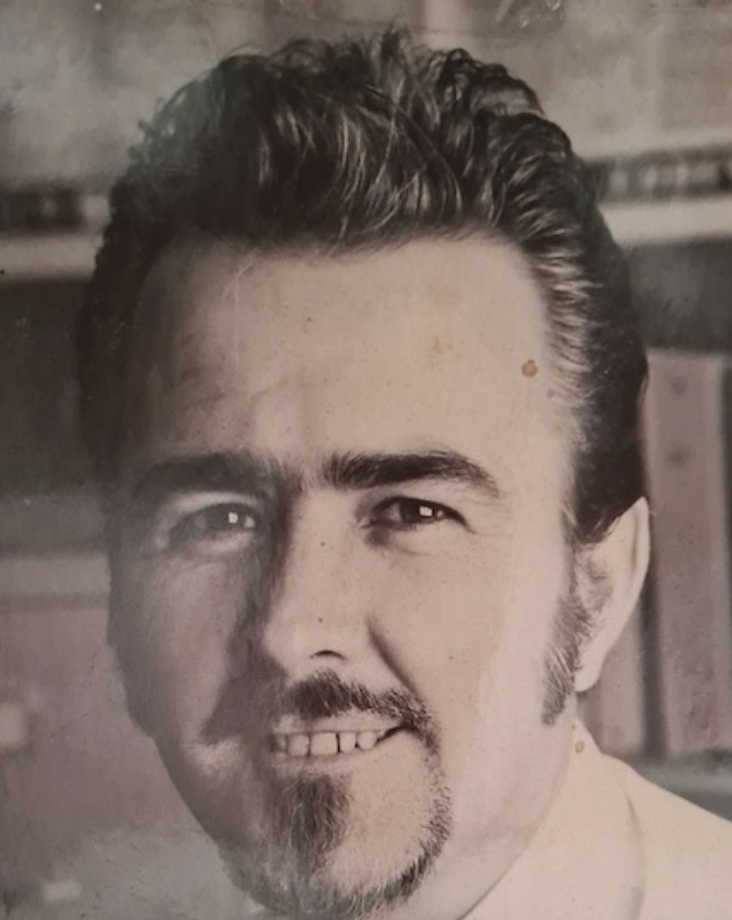

Cliff

There once lived a man called Cliff who promised his wife that upon his retirement they would have enough money to be financially secure in their dotage. He had been adding to his pension pot all his life and they would be able to retire at 55 and all would be well. There was one small flaw in his plan. He died at the ripe old age of 54 and the pension fund kept all the capital that had accrued and his wife didn’t receive a penny. That man was my father and his wife, my mother had to continue working while the pension company made millions off the back of my fathers ( and many others) 30 year monthly pension contributions

The £3000 Commission

Back in the late 80’s I knew of a certain IFA ( Independent Financial Advisor) that was licensed to sell all kinds of financial products such as life cover, insurance, mortgages etc but he only sold one product. Pensions. He would turn up to clients houses in a battered old Volvo and would sell on average 4 pensions a month. For each pension sold he would receive £3000 commission even if the client cancelled the pension after 12 months. The reason why he got such a huge commission is because pensions are the most lucrative product a finance house can sell. People pay monthly contributions into a pension for 40 years and on average they enjoy 3 years of retirement before the grim reaper comes a knocking. Those were the stats back then. Whilst your spouse might enjoy a reduced pension after your passing, the pension company keeps all the capital accrued over the 40 years. Your family don’t receive a penny.

Sudoku

The reason why people only have 3 years of retirement (on average) and why pensions are the most lucrative product to sell as a result is because we live under severe stress conditions for our whole lives and then you leave work on the Friday and on the Monday there is nothing. The brain then works against you because it has nothing to do so we keep it active by doing puzzles and crosswords. Why not swap sudoku and start investing instead? It’s much more rewarding and it could provide extra income for yourselves and your family in future years. The capital you build is yours to keep.

Conclusion

Three reasons why everyone should start investing today and the stock market can satisfy all three. If anyone knows of any other arena that can accomplish this please let me know because I haven’t found it yet. Time, temperament and logical thinking is all you need to make passive investing work for you. TIME– The earlier in life you start, the more compounding can work in your favour. TEMPERAMENT– Mistakes will be made. Even Warren Buffett makes mistakes but if you’re right six times out of ten you’ll be making money so you have to be able to take your mistakes on the chin. LOGIC– Cigarettes and vapes might be profitable now but where will they be in 20 years time? Clean energy is essential to turn greenhouse gasses around so will we be driving petrol cars in the future? Simple questions to help you invest in companies for the future.

But surely we should leave it to the professional fund managers, no? After all they have all the qualifications to manage peoples money and they have teams of analysts doing all their research for them. In my next blog, I’ll introduce my first character Freddie the fund manager and the problems he has generating profits for his clients and why as individuals we hold the advantage.

A great article and an enjoyable read, I had a play with stocks many years ago and did ok ( few hundred quid ) then life put its foot down and on we motored…..

Could you tell me the easiest way to buy and sell stocks nowadays ?

Kind Regards Andy

Hi Andrew, read this blog. It’s all detailed in there. Couldn’t be simpler these days. https://motoroaming.com/how-to-buy-shares-stock-market-investing-for-beginners/