A friend of mine asked me recently why I started investing in the stock market. After a while I replied, ‘ When I looked into stock market investing I could not believe how easy it was to setup, the ease of obtaining the research information and the powerful positive effect it can have on your financial freedom when you get it right so I said to myself ‘Myles, you simply can’t afford to not do this.’ As I draw a close to my stock market investing for beginners section Im going to ask three questions. Why, How and When.

Why invest in the stock market?

The simple answer to that question is you don’t have to. You capital is at risk . That’s what you’ll find on every financial instrument right? So why bother? Why bother risking your hard earned cash when you don’t have to? It’s a valid question. In my blog 3 reasons to start investing I suggested that building an investment portfolio provides job security in the form of passive income, a path to the other side of richness and a means to a legacy for the next generation. In my opinion, three very strong reasons why you should learn to invest in the stock market.

Steven Bartlett, of Dragons Den fame, offers an alternative view of why everyone should start investing in his podcast ‘everyone should turn their money into little soldiers’. It’s worth a listen to.

Just leave the money in the bank right? Safest place for it. Well actually… In my blog, The banking system; Friend or Foe, I posed the question ‘Is the banking system really our friend? For me personally, I simply don’t understand why anyone would put their money into a bank account at 4% (just an average) when the bank takes your money and buys BP shares returning a dividend of 6% when you can just buy BP shares yourself. Banks get richer by investing your money and telling you it’s too difficult for you to do by yourself. CODSWALLOP.

Take a look at this poor chap. Is this what you want for yourself, your children, your grandchildren? What kind of a life is that? Why do you need to invest in the stock market? Doesn’t the picture say it all. The stock market, with money invested simply and wisely, will deliver a financial stability that you never knew was possible for us average Joe’s. You worked hard for your money, now your money needs to work hard for you. Let me put it to you another way. Banks, Pension Funds and Insurance companies throw FUD ( Fear, Uncertainty and doubt) at us all our lives to take our money, invest it in shares in companies such as Coca-cola, Samsung, Shell etc, get fat off the profits thereby locking us into the hamster wheel of existence.

A house is just a house, a block of gold is just a block of gold but a company is alive with the prospect of growing and expanding and your investment in it will grow passively along side whilst you go about your daily routines. The company does all the hard work. All you have to do is a little research up front and watch your investments grow. Can you afford NOT to invest in the Stock Market? That is the million dollar question. I know my answer, what’s yours?

Now lets talk about the HOW.

How can I invest in the stock market?

OH MY GOD, couldn’t be more simple these days. Thank you, thank you, thank you Tim Berners-Lee for inventing the Internet. My only beef is why did it take you so long? Let’s roll back to 1985. Money for Nothing was in the charts, Back to the Future was in the movies but more importantly Smiley Miley had just finished A-levels and was heading into the big wide world with one goal; Get out as soon as possible and enjoy life with no plan as to how to do that. By a bizarre twist of fate, my father dying a year later proved to be a pivotal moment in my life. Being the only male left in the house, my mother thrust the ‘Readers Digest book of D.I.Y for women’ into my lap and asked if I would have a go at fixing a leaking tap. With stock market investing so far away from the realms of possibility, my property renovation career was just about to take off.

Roll on 25 years to 2010, having completed the sale of a 9 year project, I clicked on a YouTube video about stock market investing and I had a light bulb moment. The fact that you could buy and sell shares in companies from anywhere in the world using only your laptop AND the UK government allowed you to do this TAX FREE in an account called an ISA had me looking around the room to see if the Candid Camera boys were in town. 15 years later I’m writing this blog as living proof that if a kid with A-levels in French and German can do it, anyone can.

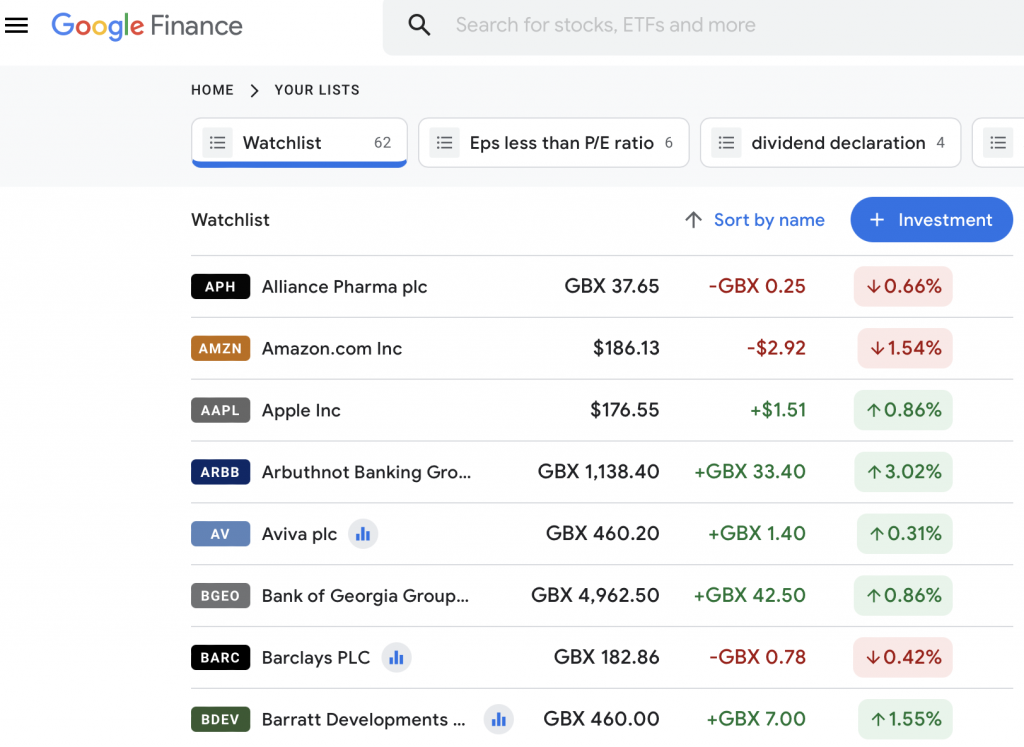

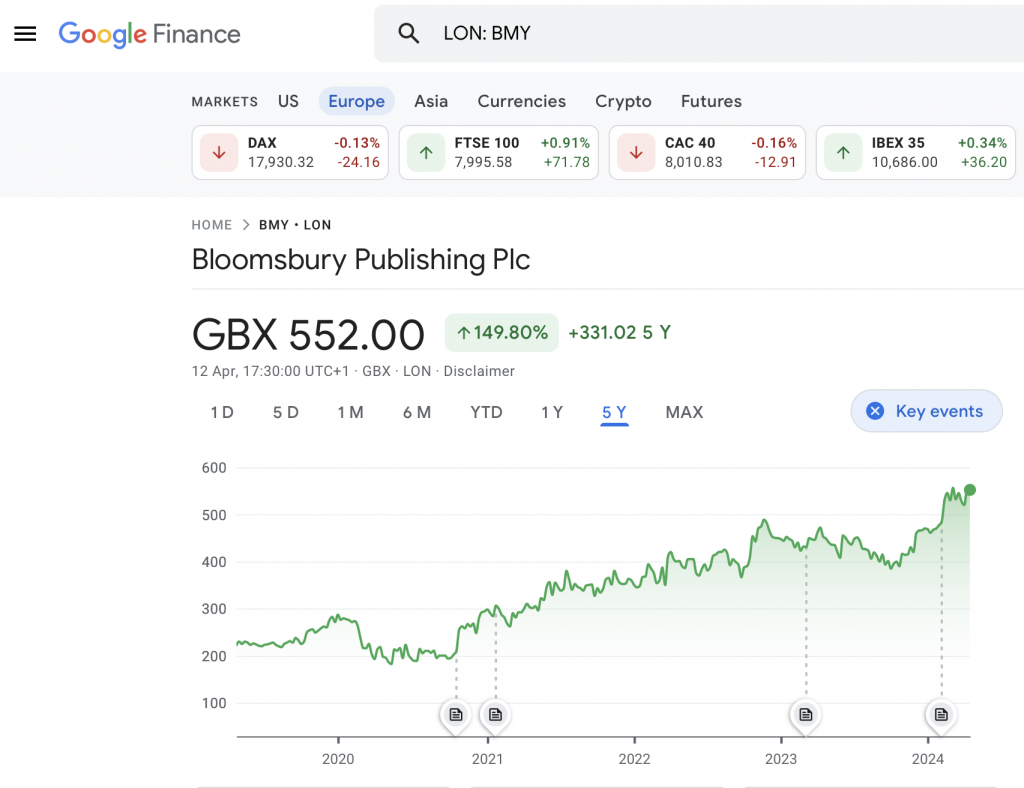

In my blog where do I start, I suggested that you only need three websites to start your investing journey. You have to do some research so you need a research website, you have to be patient so you need a watchlist and wait for the right price to buy and you need an online broker account to buy and sell shares in the stock market. I covered the research website in my blogs Stockopedia-part 1 and Stockopedia part 2, the online broker account in my blog How to buy shares and a watchlist is just a place where you keep an eye on prospective companies that you may want to invest in. I use Google finance for this because it has nice graphs and it’s free as you can see from the pictures below

Once you’ve set yourself up with three accounts ( takes about half an hour), you need a strategy and you need to stick to it. In my blog 3 proven strategies I described three methods used extensively by professionals and retail investors (that’s you and me) worldwide as a platform for disciplined investing and in last weeks blog I highlighted 5 key disciplines to help improve your returns.

That’s it! Three websites, three strategies to choose from and five disciplines to improve your returns. Not a degree in corporate management, qualification in accountancy or any other bamboozling jargon nonsense in sight.

When do I start investing in the stock market?

If it were up to me, I’d have you start investing YESTERDAY. It provides financial stability, it’s tax efficient and can ultimately change your life forever so why wouldn’t you? In my blog The rat race, I challenged the utopian life that the system provides and in my inaugural blog financial freedom, I quoted the phrase that changed my thinking about money.

DON’T WORK FOR YOUR MONEY, LET YOUR MONEY WORK FOR YOU.

ANON

The earlier you start the more you can take advantage of what Einstein called the 8th wonder of the world; COMPOUND INTEREST. Interest on interest on interest and your money grows passively in the background whilst you watch Love Island and I’m a celebrity, shoot me in the foot and hang me upside down in a tree down under (ON ICE). You are never too old to start investing as my mother-in-law will confirm. At 70 years of age I asked her why she played so much Sudoku to which she replied ‘to keep my brain active’. Why don’t you invest in the stock market then, keep your brain active and boost your income’, I cheekily proposed. That was 12 years ago and she’s still going strong so get started and have fun. Start today.

Stock Market investing for beginners: Conclusion

In my blogs Stock Market Trading and Buying Funds I introduced two fictional characters called Tracy Trader and Freddie Fund in part for a bit of fun but seriously though to impress on you that just because your company’s share price has gone down it probably has nothing to do with your decision but maybe it’s just professionals under severe pressure to outdo each other to make ends meet. Buying good quality companies at a knock down price will deliver strong returns over time and as Warren Buffett likes to say to people.

Whether it’s socks or stocks, I like to buy quality goods at a knock down price

Warren Buffett

Volatility is our friend not our enemy. The fool hardiness of others gives us the opportunity to buy shares in good quality company’s at knock down prices and therefore ultimately make good returns on our investments.

From this point on I’m going to delve deeper into the nuances of the strategies already mentioned, provide investing tools such as buying and selling checklists, what I look for when researching companies and much more.

I hope you have enjoyed my introduction to stock market investing, found it useful, de-bunked some misconceptions and found it intriguing enough to meet me in the next blog. Buy for now, err I’m mean bye for now.

0 Comments