When you jumped in the drivers seat of a car for the first time, it was all natural wasn’t it? Steering wheel, pedals, gearstick, clutch, mirror-signal-manoeuvre all fell into place and off you went. You took your test the next day and the rest is history. I don’t think so. You started the engine, put it in gear, stalled and tried again. Then you kangaroo’d down the road, barely missing mrs miggins’ dog, almost taking out postman pat on his pushbike and it was then you decided driving a car wasn’t for you, right? Well, that was my experience but slowly and surely proper disciplines were installed in me and eventually I passed my test. Stock market investing is no different. In this blog, Top 5 essential disciplines for successful stock market investing I’m going to outline the top 5 disciplines required to make capital and income profits in the stock market.

Discipline No 1: Stop spending and start investing

A Tesco’s lunch deal costs £3.40. If you work 50 weeks a year, that’s £3400 spent on lunches alone. Add soft drinks, snacks, pub lunches, takeaway meals, evening meals out, costa coffee’s and cakes (the list is endless), and you’ll be astounded by how much is spent on incidentals. Here’s a list of other things people spend their money on.

- Gym Memberships

- Sky TV

- Designer Clothes

- Magazines

- Unwanted gifts

- Lottery tickets

- Gambling

- Latest TV’s

- Latest Smartphone’s, tablets

- Newest camera’s

- Unnecessary clothing

- Unnecessary gadgets

- Scratch cards

- Sports gear you don’t need

- Trinkets

- Ornaments

- Fridge magnets

Money flows from one bank account to another. Unless to can make your money flow into an investment account and not into the bank accounts of all these businesses it it pointless learning how to invest because you’ll never have any money to invest. Next time you go to spend some money ask yourself this question. Do I want this or do I need this? If you want this then don’t spend that money and put it into your investment account instead. This discipline becomes addictive and it’s the first step to changing your life forever. And what’s even better, if you build a £5K investment pot and for some bizarre reason you lose the lot it was only money that would have been spent anyway so you’re no worse off. Make it a habit to not spend money.

Discipline No 2: Invest for the long term

Unless you win the lottery or your great uncle Bulgaria leaves you a packet you don’t build wealth overnight. It takes time. It has taken Amazon 28 years to get to the size it is today. Out of a hundred people there’s always 1 that will flip a coin and call it right 10 times in a row and tell you how easy it is. But there’s 99 that don’t. Get rich quick schemes don’t work so if you develop the discipline to always look long term you’ll be a very successful investor.

The Stock market is volatile, we all know that. You don’t have a crystal ball so you can’t see what’s going to happen tomorrow so investing in the long term provides us with a degree of safety because we can iron out the daily, weekly, monthly vicissitudes (the ups and downs) of the stock market and sleep well at night. My rule of thumb is a 3-5 year investment window so even though some of my portfolio is in the red today, I’m confident it won’t be later on down the line.

Discipline No 3: Understand the Business

When you buy shares in a company you are buying little pieces of that business.

Let’s take coca-cola. Nice and simple. It’s a soft drink. They maintain a top market share by being the worlds top brand and its distribution network is worldwide. But did you know know it also owns Schweppes (under licence), Oasis, Sprite, Fanta and many many more. Now, who has heard of bodycote? Well, it’s a provider of heat treatment and thermal processing services. It has a stockopedia quality rank of 99 and an overall stock rank of 86 so it’s a pretty good company.

However, I know absolutely nothing about heat treatment and thermal processing services so in order for me to invest in Bodycote I would have to understand the customer base, future sales potential, competitor strengths, growth potential and much more. In fact Peter Lynch’s famous quote goes like this;

IF YOU CAN’T EXPLAIN THE BUSINESS TO A TEN YEAR OLD, YOU SHOULDN’T BE INVESTED IN IT.

PETER LYNCH

Discipline no 4: Stick to your strategy

There are many strategies to making money in the stock market and I highlighted 3 very popular ones in my blog 3-proven-strategies-mastering-the-art-of-stock-market-investing. The worst thing you can do is chop and change your strategy. I speak from experience. Allocating a certain amount of cash and understanding what you want from it is key to investing success. It’s a bit like saving for a car and then buying a pushbike with the money. Now you don’t have any money to buy a car.

A great way to stick to your strategy is to group companies into classifications depending on where they are in their lifecycle. In his book , One up on Wall Street, Peter Lynch classifies companies into 6 groups. Cyclicals, Fast growers, Turnarounds, Stalwarts, Slow Growers and Asset plays. Each group will deliver a certain type of return depending on what strategy you are using. For instance if you like the idea of income dividend you need to pick companies in the Stalwarts, slow growers and cyclical categories. If you want to quickly grow your capital you need to pick companies in the fast growers and turnaround categories.

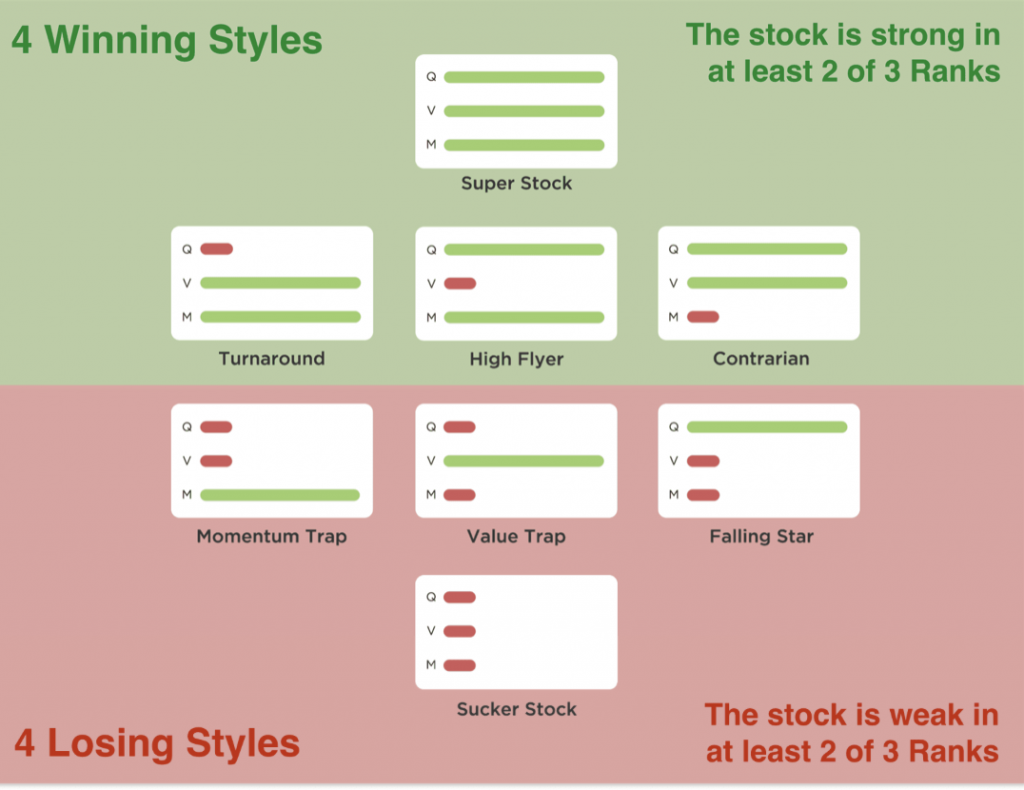

Stockopedia goes one further and groups companies into both winning styles and losing styles based on historical data. For Super stocks read slow growers and stalwarts and for high fliers read fast growers. In addition, Stockopedia have grouped companies into losing styles based on their current status (and I’m sure a complicated algorithm) so it’s very easy to stick to your strategy using these tools. Below is a screenshot of Bloomsbury and in box 1 we can clearly see it’s a high flyer and in box 2 Stockopedia gives Bloomsbury a stock rank of 86. Whilst Bloomsbury does offer a dividend, it is only 2.86% so I have it in my portfolio for capital growth. The dividend is just a little added bonus.

Boys, got some bad news for you. If has been scientifically proven that the female of our species is much better at sticking to a strategy than we are. They claim that testosterone has something to do with it but all I can tell you is that since I started to be more disciplined and picking companies that fit the strategy I’m using for them, my returns have increased significantly which is why this discipline is in my top 5 list.

Discipline no 5: Control your emotions

Nobody wants to lose money, that’s a fact. But’s it’s also a fact that even the most successful investors make mistakes from time to time and all you can do is suck it up. In my Facebook post Time and the 6 out of ten rule, I explained that investing for the longer term gives you a greater chance of maintaining your capital (if the share price has dropped in value) and if you get 6 investments of of 10 right you’ll be making money in the stock market. Again in his book, One up on Wall Street, Peter Lynch argues that you do not need to be super intelligent to be successful but you do need to have ‘THE STOMACH’ for it. You need to be able to look at your ‘paper losses‘ and say to yourself ‘Ah well, tomorrow’s another day and don’t panic sell’. In my blog, 5 key reasons for declining share prices, I outline some of the reasons why share prices drop and unless there is a fundamental change in the company’s fortunes (you’d be pretty screwed if the government banned chocolate and you owned Cadbury shares for instance), you should just ride out the storm and give you investments time to change course.

I can honestly say, that my stock market investing journey, at times, hasn’t been all candy floss and unicorns and I did consider moving back into the property world but I’m glad I stuck it out.

Conclusion: Top 5 essential disciplines for successful stock market investing

I have been guilty of lacking in all 5 disciplines over the years. My fortunes changed after reading One up on Wall Street and I would recommend this book to any potential investor. Click on the link to get a copy today.

For me, disciplines 1 and 5 are the most difficult to master. It’s so easy to spend, spend and spend some more and it took me a while to develop the stomach but now I can easily not go to Starbucks and spend £10 but instead put that £10 in my investment fund and I can look at paper losses and ignore them because I believe that the companies I’ve invested in will grow over time, they have products that are quality and will be needed way into the future. Disciplines 2,3 and 4 fall into place by using a platform such as Stockopedia

When all said and done, they are just basic disciplines that apply to all aspects of life and are not difficult to implement. In my next blog, A summary of stock market investing basics, I will bring together all the blogs so far and draw a conclusion to stock market investing for beginners. After that, I’ll take you on a journey of investing psychology, provide investing tools such as buying and selling checklists and delve into individual companies and the reasons behind my buying and selling.

0 Comments