I was only going to discuss 5 mistakes investors make when stock market investing in this blog but having done my research I need to discuss 10. I think this is the most important blog I have written so far and if you can get your head around these simple mistakes and train yourself to avoid them you’ll be on the right path. I think it’s a bit harsh to call them mistakes, they are more bad habits. I have to confess to having made 7 out of these 10 in my 15 year learning curve but now I only do 1. It’s my guilty pleasure, LOL. So what are the top 10 investing mistakes and can we avoid them.

Mistake no 1: Not investing at all

I did say that my investing journey started 15 years ago but it actually started in 1984 when BT was privatised. I didn’t have a clue what I was doing but I cut the share sales prospectus out of the paper, filled it in, bought an envelope, posted it off and waited. A few weeks later I was awarded my allotted amount of shares with a form to fill in if I wanted to sell. So I did and made a few quid. What an absolute faff. The only other way to buy shares back then was to open a broker account over the phone and speak to a broker every time you wanted to make an investment. Oh, and doing the research was even more arduous. You had to go to a library and trawl through reams and reams of mind numbing almanacs looking for clues.

In todays world you can do all this sitting on a bus, by the beach, in traffic jams or waiting for your loved one to try on outfit after outfit only to buy the first one they saw. The smartphone is a game changer.

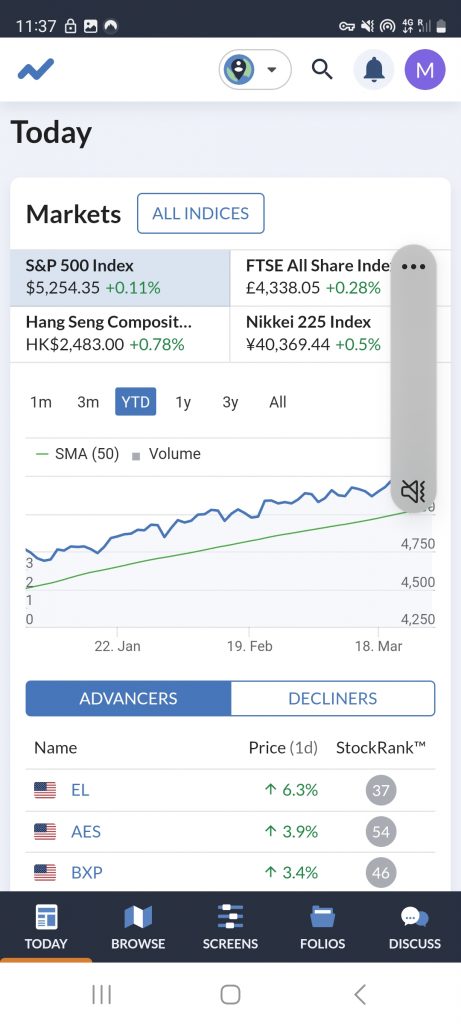

On the left is my Halifax share dealing mobile app and on the right is my Stockopedia mobile research app. These two apps give me the flexibility to control my financial well-being from anywhere in the world. I am no longer tied to an office environment. In my blog ‘stock-market-investing-for-beginners‘ I go through how you get started and in the next blog ‘how-to-buy-shares-stock-market-investing-for-beginners‘, I explain the process of using the online broker software. Information about how easy it is to use Stokopedia can be found here ‘stockopedia-the-ultimate-stock-market-research-tool-part-1‘ and continues here ‘stockopedia-the-ultimate-stock-market-research-tool-part-2’. We all know that money doesn’t make you happy but it does give you choices so why wouldn’t you give it a go?

Mistake no 2: Not understanding tax free allowances

We all have to pay taxes, that’s a given but I’ve met so many people over the years that don’t know what the government allows you to do TAX FREE with your money. For instance, say you have £10K and you have it in a savings account in the bank. Every year you pay income tax on the interest received on that money. However, if you invest that £10k in a Stock and Shares ISA (UK only), any capital gain you make (by selling shares at a higher price) or income you receive (dividend income) is ALL TAX FREE. By reinvesting those tax free returns over time you are COMPOUNDING your returns much faster than you would if you are paying a portion of your gains in income tax.

In addition, if your money is not in an ISA, the first £1,000 of dividend income you receive per annum is TAX FREE. Each individual person can also make £6,000 in capital gain every year TAX FREE. So by investing in the stock market (assuming you haven’t opened an ISA) you can legitimately earn an extra £7,000 a year TAX FREE. So why don’t you open a normal trading account, make £7,000 in TAX FREE gains and each year transfer those gains to your TAX FREE ISA account and grow your capital base TAX FREE? You don’t get it, It’s TAX FREE.

Mistake No 3: Having unclear investing goals

No different to life really. If you don’t have clear goals to achieve you just bumble along and don’t achieve much. I do like the saying ‘Begin with the end in mind’. Write your obituary. What do you want the Vicar or Celebrant to say about you at your funeral? Start there and work backwards to today and then work out how you get there. It’s no different in investing. What do you want your investing journey to achieve? Would you like to leave a cash balance to help your kids and grandkids? How about that classic car you’ve always wanted but could never afford? Saving for a house perhaps or just wanting to prove someone wrong?

I have 5 investment accounts plus 2 SIPPS (Self Invested Pension Plans) all aiming at different targets for me and the companies that I have invested in in each one reflect its’ intended target.

Peter Lynch groups companies into 6 categories. FAST GROWERS, SLOW GROWERS, STALWARTS, TURNAROUNDS, CYCLICALS and ASSET PLAYS (more on this later). Stockopedia has a similar profiling system. So, just as a basic example, if you want to go on a trip of a lifetime in two years and you invest in companies in the slow growers category, chances are your portfolio won’t reach it’s intended target.

Mistake No 4: Investing money you’ll soon need

Time is either your best friend or your worst enemy. The Stock Market does provide you with great investment returns but they are not at your disposal. Let’s say you have a 12 month deferred income tax liability and you decide to invest that money in the stock market (to reduce your liability). There is no guarantee the stock market will give you a positive return in 11 months time when you need to take the money out to pay your bill. In this situation you have to accept whatever return is available and it could be negative.

Investing in a longer timeframe helps iron out those ups and downs and allows us to benefit from the investment returns the stock market offers. A general rule of thumb is don’t invest any money that you need in the next 5 years. The longer the better.

Mistake No 5: Constantly watching the markets

Great, you’re up and running. You’ve opened an online broker account, popped some money in that you don’t need for at least 5 years, done some research and bought some shares. Exciting times. Now what do you do? Your investment portfolio changes value every minute between 8.00 AM and 4.30PM and you can see how well you are doing anywhere and everywhere.

I will admit that it is an instant gratification (a self pat on the head) when you look at the share price and you see it has gone up 3% but it also drags you down when it has gone down 3% as well. It’s a constant emotional roller coaster ride.

If you haven’t fallen into mistake no 4 and have invested for a 5 year period you don’t need to check your portfolio value on a daily (or even worse hourly) basis but the temptation is there. Would you check the value of your property if the information was readily available minute by minute? If you intend to live in your house for 5 years probably not and it’s the same for your stock market investment portfolio.

Mistake No 6: Predicting the market

I’ve got some bad news for you. You’re only human, you cannot see into the future, you do not have any special powers to be able to predict the market. All you know is that things are going to happen but you don’t know when so why bother trying to predict future events and invest accordingly when you can’t? Interest rates go up and down, recessions come and go. Storms will wipe out corn crops, civil wars will rage and governments are voted in and out. All of these events affect stock market performance so if we can’t predict anything how do we protect our investments? The only way I have found to minimise disruption to my portfolio performance is to invest in the long term, invest in good quality companies that can ride out these storms and grow stronger and invest in companies whose products will be needed by the consumer (us) long into the future.

Mistake no 7: Chasing trends

Another common mistake investors make is chasing the latest hotshot trend. The Dot.com bubble was a prime example of that. FOMO (fear of missing out) is a common human psychological behaviour that kicks in and creates illogical thinking. Just because the share price is going up is not a good reason to make an investment. If there isn’t a solid entity behind the share price it’s only a matter of time before the ivory tower collapses (because there wasn’t any ivory holding up the tower in the first place). This is why I like to invest in already established companies making actual profits (not promises of future profits) whose financials are stable (steady sales and profit growth, sensible debt management) and whose products will be needed by us 30 years from now.

Mistake no 8: Following Analysts reports

Ask yourself this simple question. If analysts reports are worthy of their content why aren’t all the analysts billionaires? Ask yourself another question. Why is there always News on the TV? Why aren’t there days when there’s no news? Let’s take a look at Maslow’s hierarchy of needs.

On the bottom of the pyramid are the Physiological needs a human requires to be happy. If you don’t meet the base level requirements you can’t move up to the self actualisation level of happiness. My interpretation of this is very simple. Everybody needs to eat. People make decisions daily to satisfy that basic of needs. In the modern day we sell our time in exchange for money so we can buy items to eat (amongst other things). Sales people sell, newsreaders read the news and analysts write reports. It amazes me how many reports I have read and at the bottom there’s a caveat. ‘The author of this report does not own shares in this company’ and the report provides a glowing picture of the future of the company’. Never ask a barber if you need a haircut.

Analysts will write anything to keep them in a job irrespective of whether it is good advice or not. You can’t blame Tarquin the analyst predicting ACME WIDGETS INC is going to be the next big thing and it turns out to be a complete flop just because you followed his advice. Acting on your own research is a much better habit to get into.

Mistake No 9: Failing to take a loss

I’ve got some more bad news for you. You’re going to make mistakes, you do not have a Midas touch, you’re only human. Even the biggest, most successful investors get it wrong from time to time.

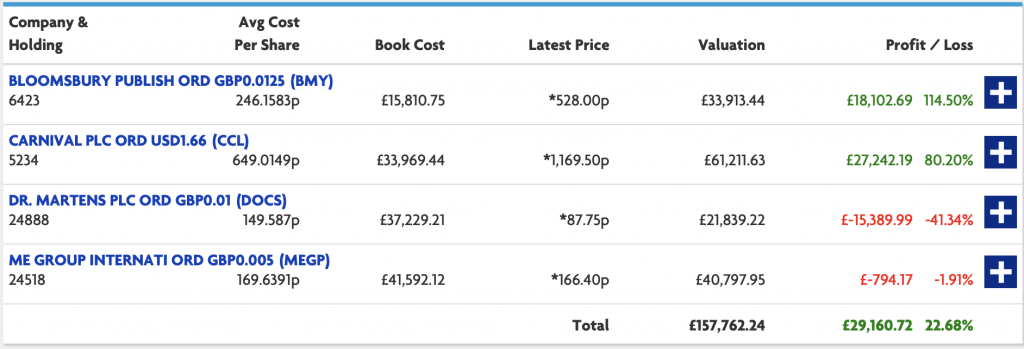

No-one likes to see red on the board but unfortunately it’s all part of investing. I’m supremely confident Dr Martens will deliver the returns I am looking for over time so I’m not concerned at the moment but I might have to take the hit if I’ve got this one wrong. You have to look at your portfolio ad a whole and with a 22% return overall I’m pretty happy with my decisions.

Peter Lynch was famously quoted as saying ‘ Keeping you losers and selling your winners is like chopping the heads of your flowers and watering your weeds.

Mistake no 10: Diversification

I’ve left arguably the most controversial mistake to last. Every single person from professional investment managers to your neighbour over the fence will shout from the rooftops ‘DON’T PUT ALL YOUR EGGS IN 1 BASKET’. Modern portfolio theory is based on a well balanced portfolio diversifying into different sectors and company profiles to reduce risk and provide maximum returns from a wide range of investments. Any fund manager ought to get you returns of 9% on average investing in this way. This is a perfectly sound investing strategy if you have a 30-40 year time period in which to compound all the profits year on year but, and here is the big but, this is not a good strategy if your aim is to grow your capital base fast.

For the most part of my investing career, my portfolio was based on this type of strategy; a group of 20-30 diversified companies providing an element of risk safety and average returns. Then I heard Warren Buffett comment that investing in good quality companies is the way he and Charlie Munger invest their capital and there aren’t that many good quality companies out there so how good do you think you need to be to pick 20-30 of them for your portfolio. If truth be known, you only need one. One company that grows and grows and builds wealth along the way. For instance, if you invested £20,000 in amazon in 2010 you would now be sitting on £600,000 of net worth without lifting a finger in the meantime and without re-investing any dividend returns.

I used to have a portfolio of between 20-30 company’s but no I concentrate on just 6. As Warren Buffett quite rightly says ‘It’s OK to put all your eggs in one basket, just watch that basket like a hawk.

Stock market investing mistakes: The top 10 to avoid: Conclusion

As I pointed out in the introduction, these are not so much mistakes, more bad habits. Investing is a disciplined business not a complicated one and if an experienced pilot goes through his checklist every time he takes off there’s no reason why we shouldn’t do the same. Using this blog as checklist before you buy would be a good starting point just to keep you on the right track. In my next blog, Top 5 essential disciplines for successful stock market investing, I’ll discuss what disciplines you need to adopt to get maximum returns from your investing timeline. Bye for now.

Oh yeah, my guilty pleasure? I can’t help but take a peak at the markets a few times a day. I love it, It’s fun. LOL

Just a point on the tax section. 2024/25 CGT IS £3000, (£1500 for trusts) Any losses you need to “claim” them and have 4 years to do so. Use losses by the way to offset gains… they reduce the effect of loss especially in new tax year. £1000 interest free is for basic rate, higher rate is £500. ISA allowance £20/- per adult.

Dividend income now £500 Pa.

Use stakeholder allowance £2880 grossed up to £3600 (720 free money) regardless of income as long as ur under 80. Plus 25% is tax free on withdrawal (900) balance of 1980 taxable at ur highest rate of income tax … oh an remember u can reallocate ur married persons allowance…hope that helps

I’m sure the detail of your information is accurate (I’m no tax accountant) but you have highlighted the issue perfectly. People don’t know what they can claim for tax free which in my view should be a criminal offence LOL.

Nice returns on that portfolio! But the SP500 is up over 24% in the past 12 months? Is it worth all the effort looking for undervalued companies – why not just buy a fund which tracks the market?

I don’t think the S&P will keep returning those figures but buying index tracking funds is certainly a great way to invest your money.