In the last blog, The 5 key reasons for declining share prices, I gave you the bad news. In this blog, The 5 key reasons for rising share prices, I’m going to give you the good news. There are many reasons why share prices rise and the more you know the better off you will be in identifying good stock market investments.

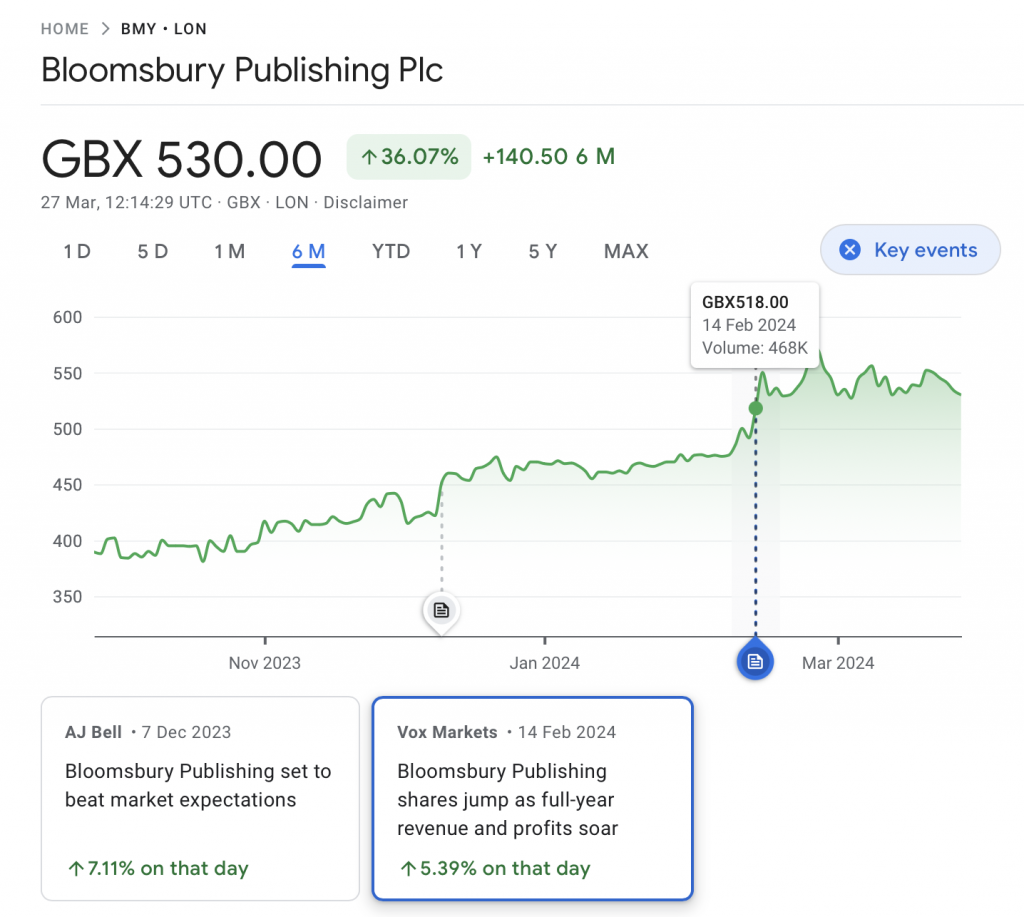

Reason 1: Profits beating expectations

As part of the RNS, Companies listed on the stock market have to provide profit expectations for investors of all sizes to analyse their investing decisions. If a company then reports that profits have beaten expectations, Freddie Fund loves this. It’s the old adage, offer less, deliver more. Remember how you felt when you ordered a new sofa with a 12 week delivery date and you got a call after 10 weeks to say it’s here, when can we deliver. You feel great. It’s no different in the stock market. The whole point of running a company is to make profits so looking for companies that are increasing their profits annually is a good strategy to adopt.

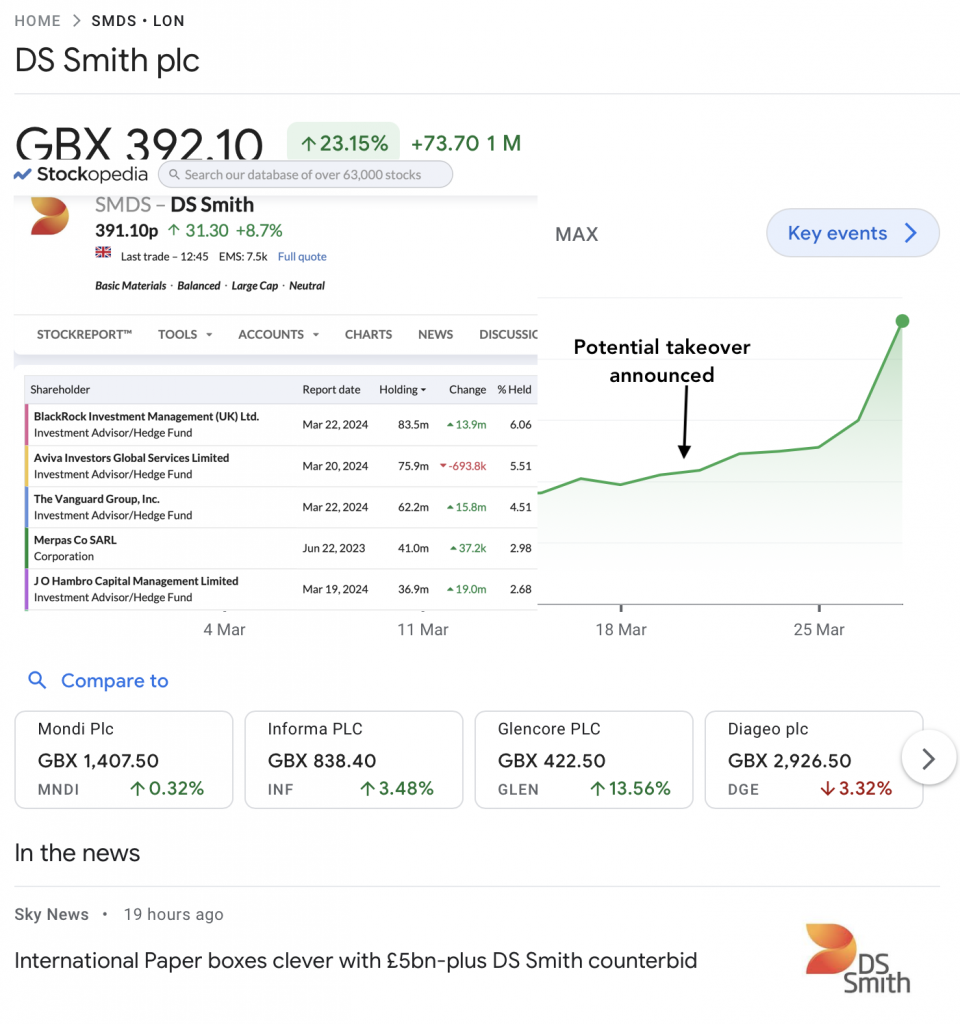

Reason 2: Company takeovers

Let’s say you own a classic car worth £10,000 and I want to buy it. If I offer you £10,000 for it you’ll decline my offer because there is no incentive for you to sell. You’re only getting face value but if I offer you £15,000 you may be tempted to sell it to me. The higher I go the more chance I have of acquiring my dream classic car. It’s no different when companies want to buy out other companies. What’s the point of shareholders selling their shares at current market price? ‘Come on then, make me an offer I can’t refuse’ is the saying. Generally speaking if company A wants to buy company B, there has to be a 30% premium to market value. You can see in the case of DS Smith there was a potential takeover announced on the 19th May and fund managers piled in raising the price accordingly.

Reason 3: “Ick” Investing

Bad news is good news

In a world of uncertainty, certainty is king. Companies, by the simple fact they are run by humans, make mistakes. They misdemeanour leading to court cases as an example. Happens all the time. As soon as an impending court case is announced, Fund Managers sell off drastically because they simply don’t know which way the case will go. This is an ‘Ick’ moment in a company’s life. Dr Mike Burry loves these moments. The big sell off represents a huge share price drop and an opportunity to wait and see what the outcome of the case may be. If the company is acquitted, Fund Managers will start to buy back leading to share price rises. Having a watchlist of all companies going through court trials from food poisoning ( in restaurant chains) to price fixing shenanigans can lead to share price rises once the outcome has been published. These are called TURNAROUND opportunities.

Reason 4: The pump and dump

Caveat Emptor: Let the buyer beware

A person of stature buys a huge chunk of a companies stock in order to initiate the “GREED” in others. Everyone’s watching what’s happening everywhere and if you see a person ‘making a move‘, (the pump) you think that they know something about this company so you invest yourself. The more people invest the higher the price rises. However, this particular individual only wanted you to think that his investment was meaningful but in fact all he wanted to do is initiate a buying frenzy so he could sell at a higher price (the dump) and make a tidy profit. As unscrupulous as this activity is, these people have the power to manipulate share prices just buy the sheer size of their buying power.

Reason 5: Stock market bubbles

It’s just human nature. A bubble arises when humans throw all logical thinking out of the window and speculate on the value of stock purely based on the fact that ‘IT’S GOING UP’. All rational sense is lost as they lose their marbles and borrow off the house and credit cards to make even more money. Disaster myopia has kicked in; a condition where the further you are away from the beginning the more you convince yourself that nothing is going to go wrong. A crash is inevitable in this instance, it’s just when?

The 5 key reasons for rising share prices: Conclusion

Every scenario provides an opportunity to make money in the stock market. I’m sure you can all see that having an investing strategy that encompasses the ideas of the 1st three reasons should provide a much more stable base from which to work from than the last two. The whole essence of investing, for me, is staying away from the last two reasons even though there are significant gains to be made. In my next blog, 5 common investing mistakes to avoid, I’m going to discuss 5 common mistakes investors make and how you can avoid them. Bye for now.

0 Comments