Human beings are not perfect, we are all flawed in some way so it should not come as a surprise to you to know that even the most educated and talented of us make mistakes. Therein lies opportunity. In this blog, The Turnaround strategy: what you need to know, I’m going to demonstrate that buying companies after they have made a booboo is a very profitable strategy in stock market investing.

The Psychology of Humans

Trying to unravel the psychology of the human being is a minefield as you can imagine. You can take degrees in the subject so it’s not hard to realise that from time to time we make mistakes and errors of judgement. It’s what makes us us. How else can you explain the inevitable boom and bust of stock market bubbles? Back in the early 1600’s irrational trading of tulip bulbs in the Netherlands caused a massive stock market crash and everyone lost their money. This happened again in 1720 when The south sea stock market crash caused Sir Isaac Newton to comment on the madness of man (he himself lost a packet). In 1929 the Great Depression was caused by irrational human behaviour in the markets. History, it would seem, is littered with such events and even recently as 2008 we witnessed the credit crunch fiasco that almost melted the whole world economy. So why don’t we learn from our mistakes?

Let me throw some words on the table.

- Insecure

- Arrogant

- Bravado

- Irrational

- Conceited

- Selfish

- Irresponsible

- Greedy

- Fearful

This list is only a fraction of the traits that make up the human psyche and at any given point in time we can display all or none of these which is why Warren Buffet famously quoted.

Be fearful when others are greedy and be greedy when others are fearful

Warren Buffet

Given that the human being hasn’t changed much in the last 5000 years or so it is not outside the realms of probability to assume that these traits, or faults if you like, are built into our DNA and everything we do and every decision we make will carry a degree of imperfection in it sometimes with devastating consequences. Will we have another stock market bubble and subsequent crash? Will the management of a company make such idiotic decisions as to tank the share price? HELL YES. Time and time again. Should we as investors be concerned by this? Absolutely not. Bad news is good news for the turnaround strategy leading Warren Buffett again to quote

Whether is socks or stocks, I like to buy quality goods at a knock down price

Warren Buffett

The Turnaround Strategy

This strategy is based simply on finding good quality companies that have done something wrong, waiting for them to correct the error and buy into that company when you see signs of a turnaround situation. Here are two such examples.

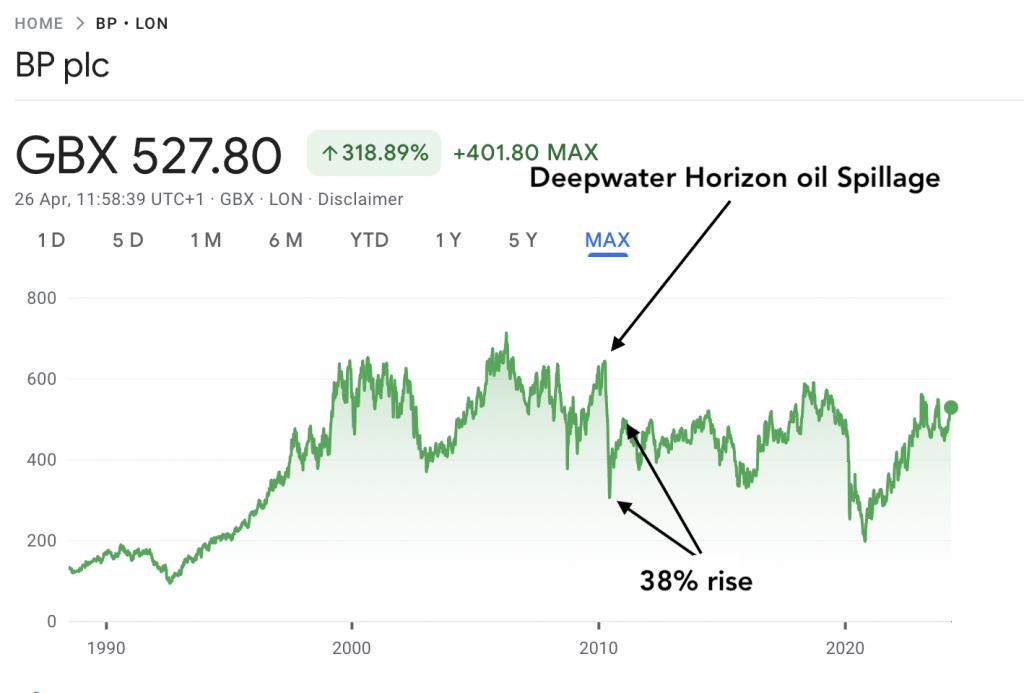

Who remembers the Deepwater Horizon oil spillage in 2010? Catastrophe. It was all over the news. Environmentalists jumped on it like a rash. What made the problem even worse was that the CEO at the time was asked how long the spillage would take to clear up. His reply was a classic. ‘soon, I hope. I want my life back’. He showed no sympathy by the damage caused to the natural environment and wildlife that had died as a result. As you can see the share price tanked. But only a few months later when the CEO resigned and the clearup was in full flow the share price started to rise netting a 38% profit for turnaround investors.

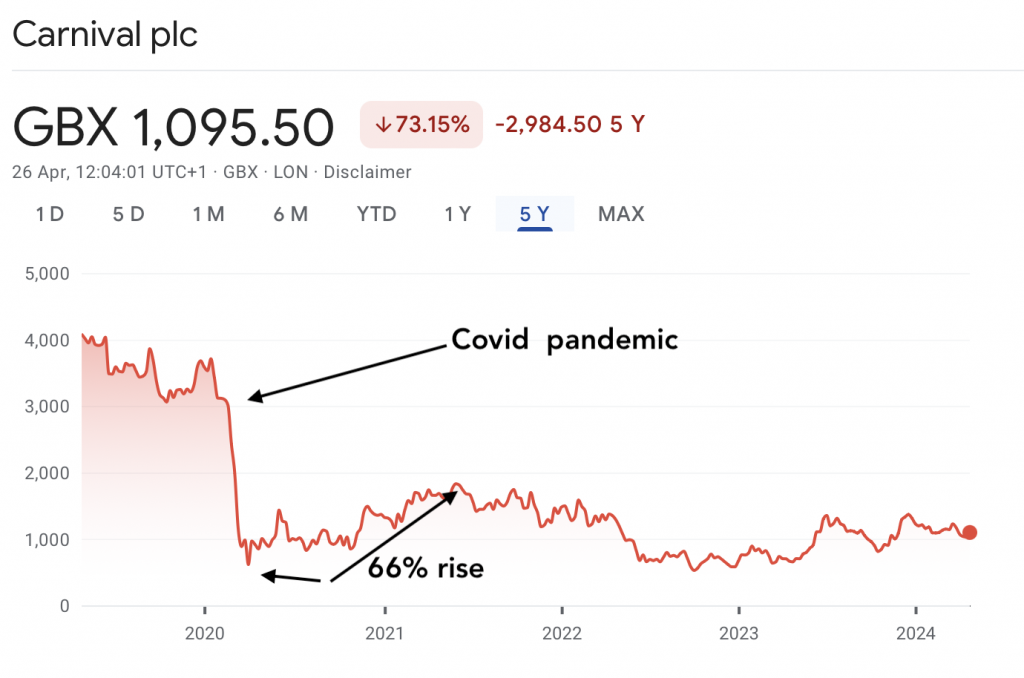

Through no fault of its own, Carnival share price tanked due to the Covid pandemic as all ships were grounded effectively halting all revenue streams for the company. Carnival had to take on huge amounts of debt to keep it afloat (pardon the pun) because the leisure industry was one of the sectors not helped out by governments and it remains the same to this day. So now you have the largest cruise line companies in the world with no form of income stream taking on huge debt and no idea when they would be able to sail again. However, some turnaround investors cashed in on a 66% rise .

Unfortunately I wasn’t investing in 2010 so I didn’t take advantage of the BP crisis. My opinion of it at the time was that the spillage would be cleared up, the CEO would be removed and BP would have their knuckles rapped and pay a huge fine which is exactly what happened.

Carnival was different. Would covid be a thing of the past? Would ships be allowed to sail and would punters come back to fill the cabins? My thoughts were absolutely yes but was it going to go bust before it could turn the tide? It had taken on 34 billion in debt and creditors only have so much patience. For me, carnival came into the ‘Too big to fail’ category. If creditors pull the debt and make carnival go bust they would own 27 cruise ships with no one to sell them to because all other cruise line companies were in the same situation. I bought in at £7.45 and this year it is expected to return to profit having announced a bulging order book. There’s still debate about it’s future due to the wars going, the Baltimore bridge disaster and the rise in living costs (people can’t afford to go on a cruise at the moment) and these situations haven’t helped general sentiment which is why the share price rise has stuttered a little in recent months but there’s no doubt the wars will end, the bridge will be rebuilt and people are so stressed due to the modern pressures of living they go on cruises anyway even if they can’t afford it, the cost goes on credit so I have no problem with the future of Carnival but that’s just my opinion. Take a look at the picture below. Seems I am not alone. Not that I take much notice of articles but here’s the link if you want a read.

The Turnaround strategy: Conclusion

Coca-cola, Hoover, SunnyD and many many more companies have made themselves turnaround opportunities over the years due to cockups of their own or global events that are out of their control and the Turnaround strategy can take full advantage of these errors. Ask yourself this question. Are you ever going to have an opportunity to buy Carnival shares at £10.90 again?

Success in the turnaround strategy relies on five disciplines; You need to

- Be excited when bad news breaks. Bad news is good news; It could be an opportunity

- Understand the problem. Is it a one off event or is it more terminal?

- Understand its debt position. Is it going to go bust as a result?

- Be patient. Wait for signs that the company is starting to correct the issue

- Be bold. Are you ever going to buy those shares at that price ever again?

What is comfortable is rarely profitable

Robert Arnott

The Turnaround strategy is not as comfortable as dividend investing because you have to be a little contrarian. You have to be able to see what others don’t and this is only the same as renovating a house or doing up old cars. The face book group, T-shirt Investor has been setup to discuss stock picking options before you dive in so if you’re not a member head on over and join in.

My recommendation for moving forward would be to start with the dividend strategy but also play the Turnaround strategy with Monopoly money and see if you can spot some winners.

In my next blog The growth strategy: What you need to know, I’m going to discuss how to make profits in the stock market by buying shares in fast growing companies. Enter the High fliers. Bye for now.

0 Comments